Stocks, Bonds, Cryptos, and everything is crashing! Here are some steps that you can follow and stay on course!

Let’s assume a Ship has been chartered to carry a few thousand containers from the port of Shanghai and off-load them at Los Angeles. The containers get loaded onto the ship, and the crews secure them onboard. The Captain receives the voyage orders, and he asks the officers to prepare a passage plan from Shanghai to Los Angeles. She sails through the deep and dark waters of the Pacific Ocean, staying on her course. The crews ensure the safety of the ship and the cargo so that the ship reaches its destined port on time using the optimum quantity of fuel. The Captain and his crews are fully responsible for the freight from the time when loaded onboard in Shanghai and off-loaded in Los Angeles.

With the above being said, let’s look at the stock markets & personal finance.

- Every ship and its journey is entirely different from other ships. Personal finance is akin to it, so it has to be personalized.

- As every ship has a Captain, you are the Captain of your financial life.

- A ship encounters rough weather, which may throw her off the course, but she will overcome it to reach her destination. Likewise, the markets are always volatile, throwing you off the course. All you need to do is stick with the plan and keep moving towards your goal.

Let me explain how I am handling the current market situation:

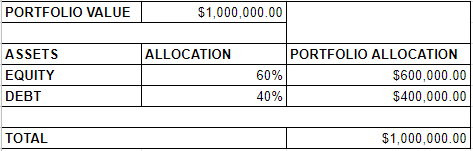

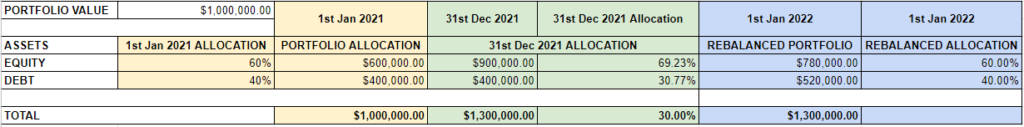

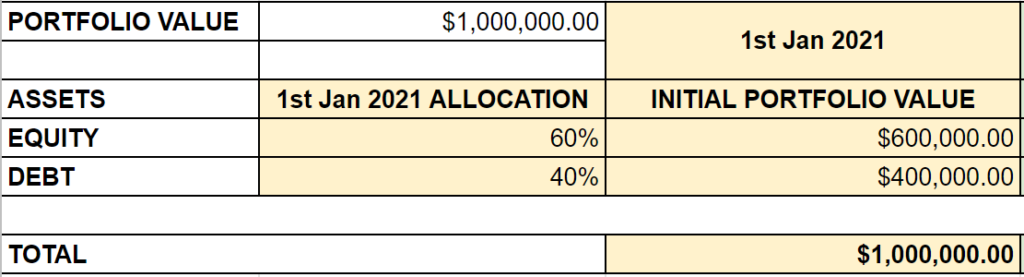

Let’s assume that the overall asset allocation is 60:40 (Equity: Debt) — for simplicity, and I have eliminated real estate/gold or any other asset class. For a portfolio to do well, you need a mix of assets that collectively work favorably. In its simplest form, asset allocation is how your investments are distributed among the different asset classes such as fixed income, equities, real estate, gold, and even cash. For this reason, asset allocation is an essential factor in determining that a portfolio performs in line with an investor’s goals and may help you achieve better returns while lowering risk.

Asset Allocation at Start/Target:

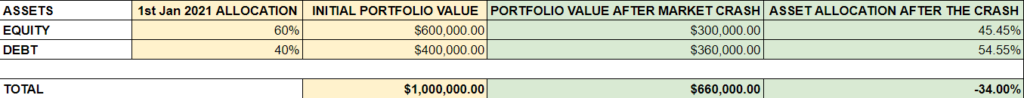

1st January 2021:(Dates and Portfolio values are stated for explanation purposes)

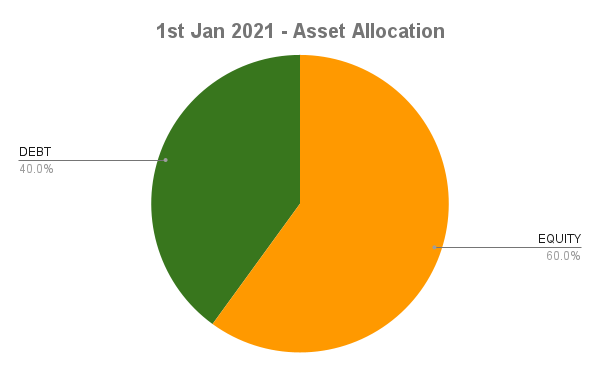

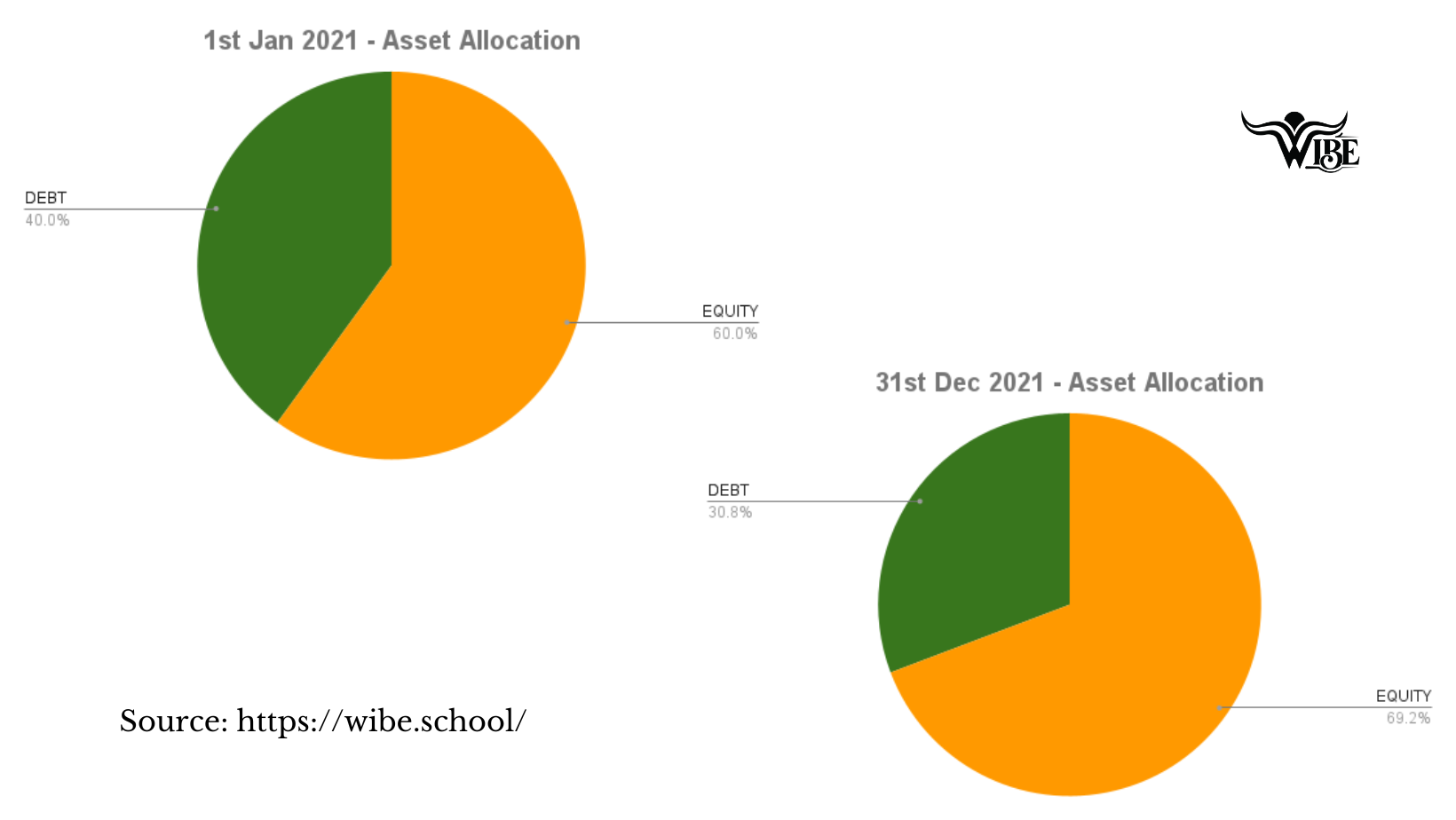

The above data looks like the pie chart below as of 1st January 2021

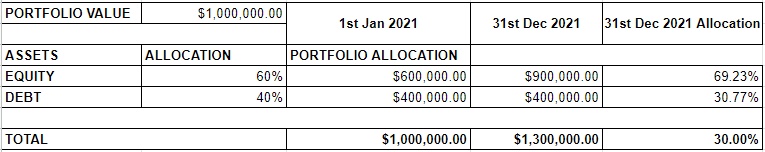

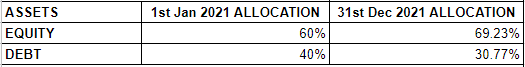

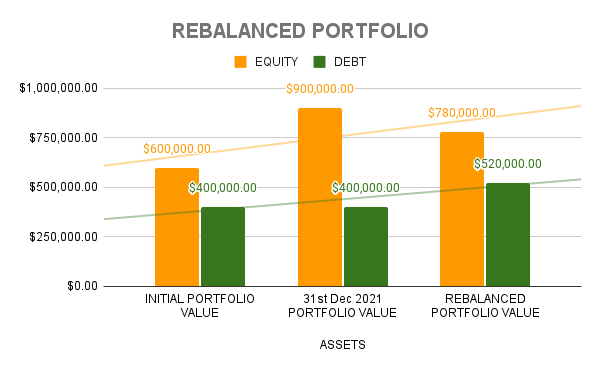

Let’s assume the equities have gained by 50% and debt by 0% by 31st December 2021 (hypothetical scenario). The Portfolio value and asset allocation changes are as below.

Although the equities have gained by 50%, the overall portfolio has gained by 30% only as the debt has gained 0%.

The equities part has grown from 60% to 69% of the overall portfolio. An investor has two options in this scenario:

- Rebalance from high-risk asset to low-risk asset (make the equity: debt allocation from 69:30 to 60:40)

- Leave the portfolio as it is (which I do not recommend)

Here is what a rebalanced portfolio will look like.

Asset Allocation During a Market Crash:

We are on the verge of a global recession, as pronounced by most economists, and the stock indices of most countries have corrected by at the least 15% ~ 20%. I have to admit that this is the first time most of us are experiencing the market turmoil where stocks, bonds, and cryptos are getting crushed. Sky-high inflation along with supply constraints are driving commodity prices high. With all that being said, can investors protect their portfolio against Inflation or Invest in Stocks that would appreciate during periods of high inflation?

While a conventional 60:40 (Total Stock market equity: Total Bond Market) portfolio has not much lee-way to play with, a slightly diversified asset class can help investors hedge their portfolios.

Let’s see what shall happen to the conventional 60:40 equity: debt portfolio when the market crashes, say equity by 50% and debt by 10%

For discussion, let’s assume the market crashes where the equity halves its value (50% fall) and the debt falls by 10% (hypothetical scenario).

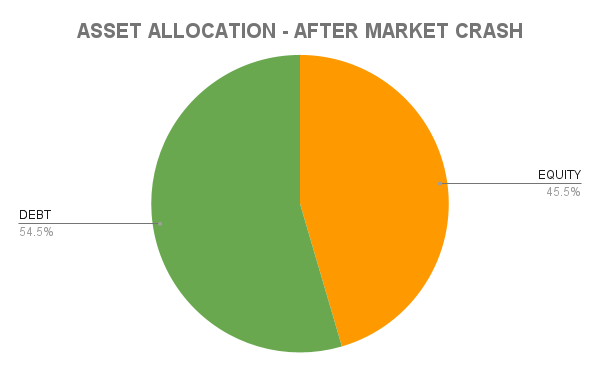

The portfolio experienced a draw-down (unrealized loss) of 34%, although the equities fell by 50% and the debt fell by 10%. The new asset allocation ratio becomes 45:55, which must be rebalanced.

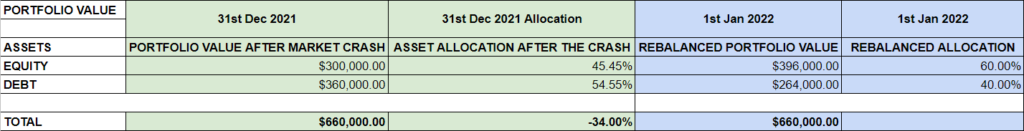

The equity: debt asset allocation must be rebalanced from 45:55 to 60:40 (back to the original target ratio). Thus, investors may have to sell some part of the debt allocation and re-invest the proceeds in the equities.

Some Noteworthy Points:

- Based on the individual investor’s risk profile, rebalancing must be done at a comfortable ratio (expressed in %). My rebalancing triggers are at every 10% offset. By this, I don’t wait till the equities crash by 50% (which I do not know when the markets will bottom out and reverse).

- I prefer to have an Equity: Debt ratio of 60:40, tied to financial goals.

- As we get closer to the financial goal (both in terms of the required corpus and the time), it is essential to reduce the equity exposure and shift to the debt part (from high-risk to low-risk assets).

Reasons to Diversify Beyond two fund ETFs:

What we are experiencing from early 2022, there could be scenarios where stocks, bonds, cryptos, and all other assets may crash simultaneously. Thus, a two fund ETF might not have enough lee-way to hedge or lower the portfolio draw-down. The S&P 500 (SPY) has fallen by about 17% (08-J-2022) from its all-time high, whereas my well-diversified soccer team portfolio has fallen by 11% (lower draw-down). Further, I have hedged my portfolio in a couple of ways, as mentioned in this blog — 2 Simple Ways To Hedge Your Portfolio — A Data-Driven Approach.

Maintaining an appropriate asset allocation is critical to aligning your investment strategy with your overall investment objectives. Of course, asset allocation does not ensure a profit or protect against a loss, but by maintaining the asset allocation, you reduce the probability of loss to your investment. Asset allocation is not a one-time process; it is a dynamic process that should be maintained periodically because market movements can dramatically alter your asset allocation over time. Most importantly, rebalancing keeps your portfolio consistent with your risk profile.

Rebalancing establishes good investing habits. It may seem counterintuitive to sell an asset that’s performing well, but that’s precisely what you should do. Rebalancing forces you to buy low and sell high. Setting goals helps you match your time horizon to your asset allocation, which means you take on the optimum amount of risk.

How To Handle When Stocks, Bonds, Cryptos Fall at the Same Time?

We are on the verge of a global recession, as pronounced by most economists, and the stock indices of most countries have corrected by at the least 15% ~ 20%. I have to admit that this is the first time most of us are experiencing the market turmoil where stocks, bonds, and cryptos are getting crushed. Sky-high inflation along with supply constraints are driving commodity prices high. With all that being said, can investors protect their portfolio against Inflation or Invest in Stocks that would appreciate during periods of high inflation?

While a conventional 60:40 (Total Stock market equity: Total Bond Market) portfolio has not much lee-way to play with, a slightly diversified asset class can help investors hedge their portfolios.

Diversification is not just in asset classes but also in geographies. I have written a couple of blogs on how I hedged my portfolio in a data-driven approach here — please feel free to read them – Click the links below:

I hope this was useful, and do your due diligence if or when placing a trade/investing. All ideas stated here are my own and do not represent trading or investment advice.