With Inflation running red hot across the globe, here are some ways to Invest in Inflation!

In my previous blog, we discussed a practical & data-driven approach to hedging your portfolio. We are on the verge of a global recession, as pronounced by most economists, and the stock indices of most countries have corrected by at the least 10% ~ 15%. I have to admit that this is the first time most of us are experiencing the market turmoil where stocks, bonds, and cryptos are getting crushed. Sky-high inflation along with supply constraints are driving commodity prices high. With all that being said, can investors have a thematic investing approach to protect against Inflation or Invest in Stocks that would appreciate during periods of high inflation?

It seems we can!

I was trying simple but effective ways to hedge my portfolio and read about two ETFsread about two ETFs dedicated to Inflation. In this blog, we will be discussing the two ETFs where investors can consider having exposure to investing in inflation or hedging their portfolio!

Before we move forward, please:

Do your due diligence if or when Trading or Investing. All ideas stated here are my own and do not represent trading or investment advice.

Disclaimer: This is not a buy/sell recommendation and is shared for information & knowledge only. The author is not a professional (or) qualified investor, and the articles are not investment advice or a recommendation or advice of any sort. All the analysis/data are from the public domain, like, but not limited to, Yahoo Finance, Google Finance, and Investing.com.

Consult your financial planner for any investing decisions. This article is not a paid promotion, and the expression in this article is solely the author’s research & analysis. While anyone can give a stock “BUY” recommendation, investors must have a strategy and know when to “SELL” a position. Do your due diligence, and everything is at your own risk.

Inflation — Where are we now?

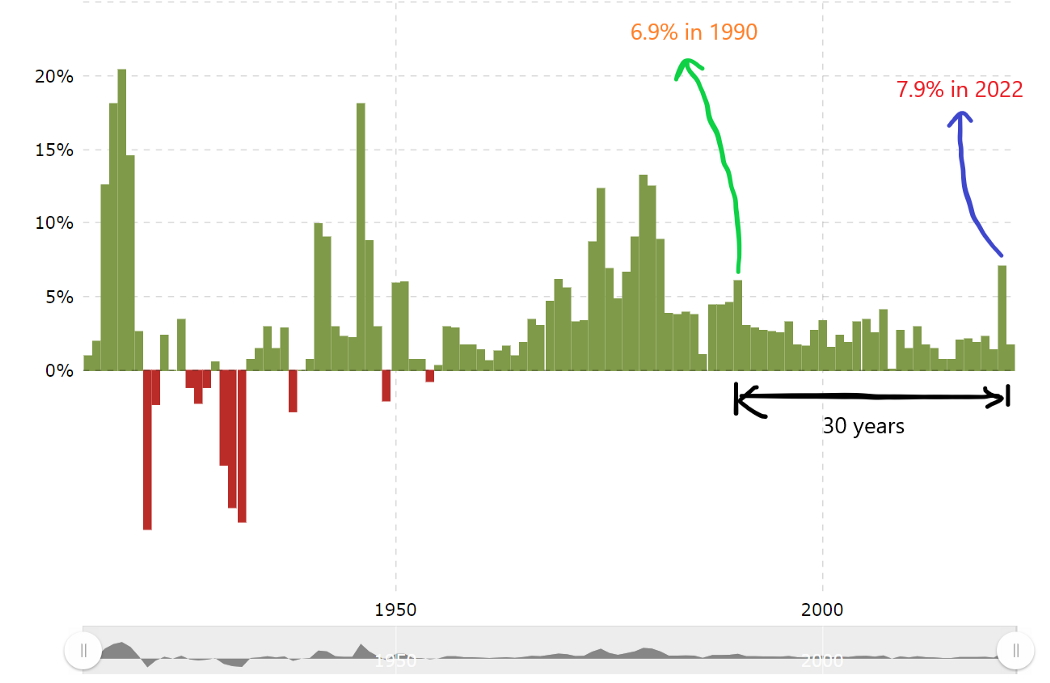

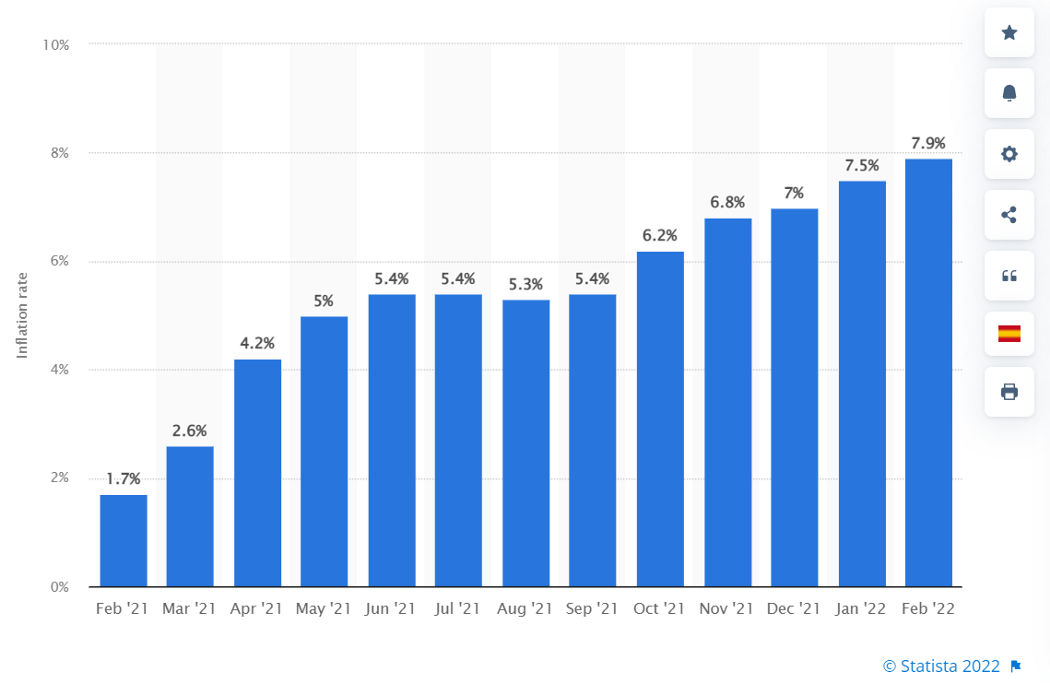

The United States recorded an inflation rate of 7.9% in February 2022, and that’s pretty high. In February 2021 inflation rate was around 1.2%, and it has increased drastically in the past twelve months. We are experiencing such high inflation after 30 years.

Is the inflation really at 7.9%?

The chart from Statista shows the monthly 12-month inflation rate in the United States from February 2021 to February 2022

What’s Inflation & Why Worry?

Inflation is the decline of purchasing power of a given currency over time. If you had purchased a meal for $10 a few years ago, you would have to spend $20 for the same quantity and type of food. Inflation is a measure of the buying power of a dollar or any currency. It tells us how much more an item will cost down the road due to the costs of producing something (labor, materials, etc.) going up over time. That loaf of bread that you buy today for $2 would have only cost about 50 cents a few decades ago. On the flip side, that loaf of bread will cost $4 to $6 in a couple of decades due to inflation.

With all that being said about inflation, let’s focus on how to invest in Inflationary Periods?

I prefer the ETF route because of the reasons mentioned below, but not limited to:

- A professional fund manager manages it

- The fund house takes care of the stocks, allocation, rebalancing, etc.

- All that I have to do is “Know What ETFs to BUY & When to BUY & SELL.”

Without much further ado, The Two ETFs with which you can invest in Inflation are:

- INFL — Horizon Kinetics Inflation Beneficiaries ETF

- FCPI — Fidelity Stocks for Inflation ETF

There could be several asset classes and multiple ways to hedge your portfolio or invest during inflation. My easiest choice is to go the equity ETF way which I understand better than any other asset class.

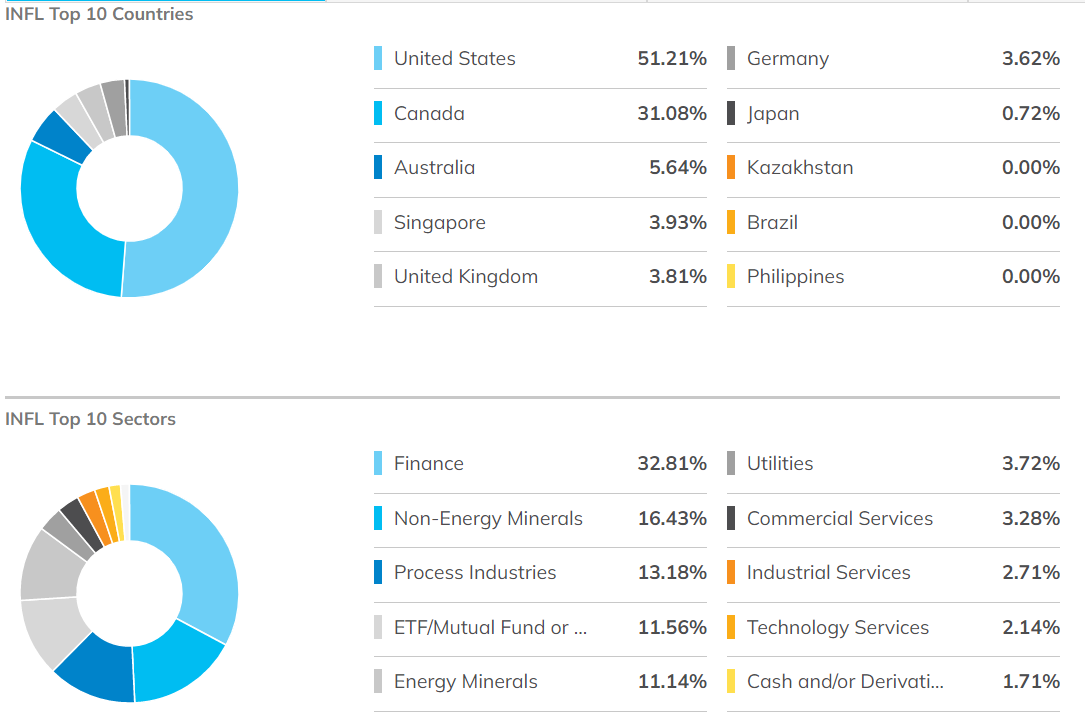

INFL — Horizon Kinetics Inflation Beneficiaries ETF

The Horizon Kinetics Inflation Beneficiaries ETF is an actively managed ETF that seeks long-term growth of capital in real (inflation-adjusted) terms. It seeks to achieve its investment objective by investing primarily in domestic and foreign equity securities of companies that are expected to benefit, either directly or indirectly, from rising prices of real assets (i.e., assets whose value is mainly derived from physical properties such as commodities) such as those whose revenues are expected to increase with inflation without corresponding increases in expenses.

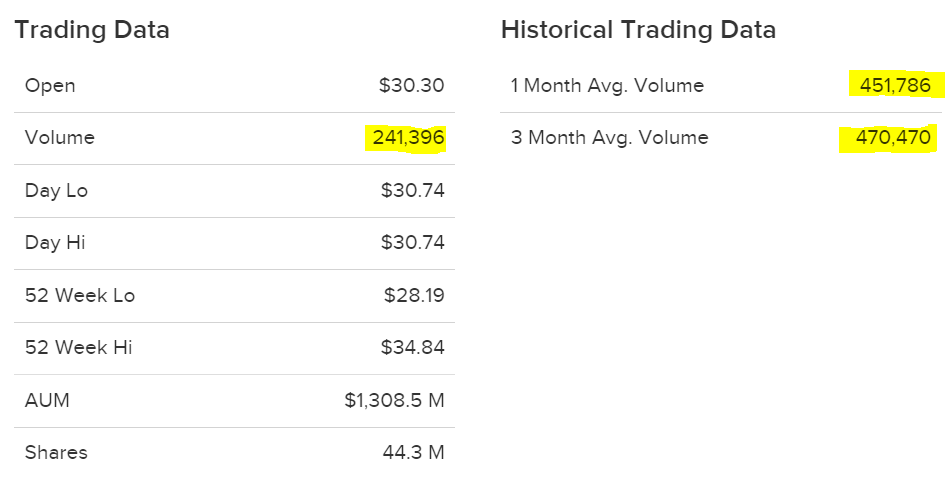

The top 10 holdings account for 43% of the total portfolio.

The Good:

- INFL is appropriate for investors looking for short-term inflation protection.

- Exposure to global companies

- Targeted Exposure toward Inflation beneficiaries

- The ETF may hold companies involved in Exploration and Production, Mining, Transportation, Infrastructure, and Real estate (emphasizing “asset-light” businesses with royalty, streaming, rental, brokerage, management, and leasing exposure). INFL may also have significant exposure to securities exchange companies.

5. Exposure to most developed economies with 51% exposure to the US equities.

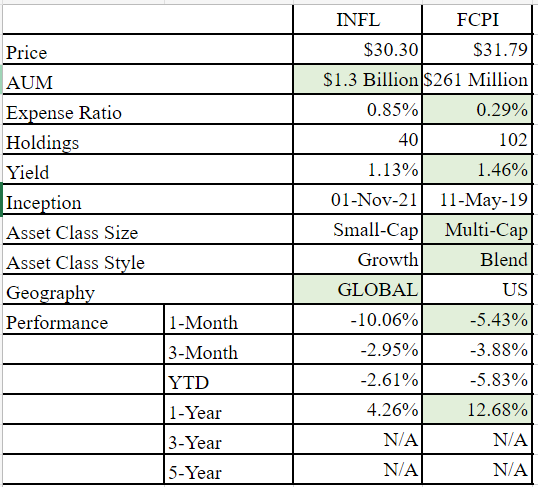

6. With the total number of holdings at 40 (a concentrated portfolio), the ETF yields 1.13% (based on the current market price)

The Bad:

- The ETF was incepted on 01-Nov-2021, and it is not even barely a year old — The fund has a limited history, only going back a few years. Thus, investors have to know that INFL ETF may not be a BUY & HOLD forever and may come in handy during periods of high inflation.

- The expense ratio is 0.85% — meaning investors will pay $85 annually as a management fee for every $10,000 invested. Personally — I feel this is expensive for an inflation play.

- The ETF holds more small caps — and thus, one has to be ready for higher volatility than the mega and large caps.

- The total volume traded is relatively low, and there might be liquidity risk. Hopefully, the volumes will pick up as the ETF gains popularity in the coming months.

Performance:

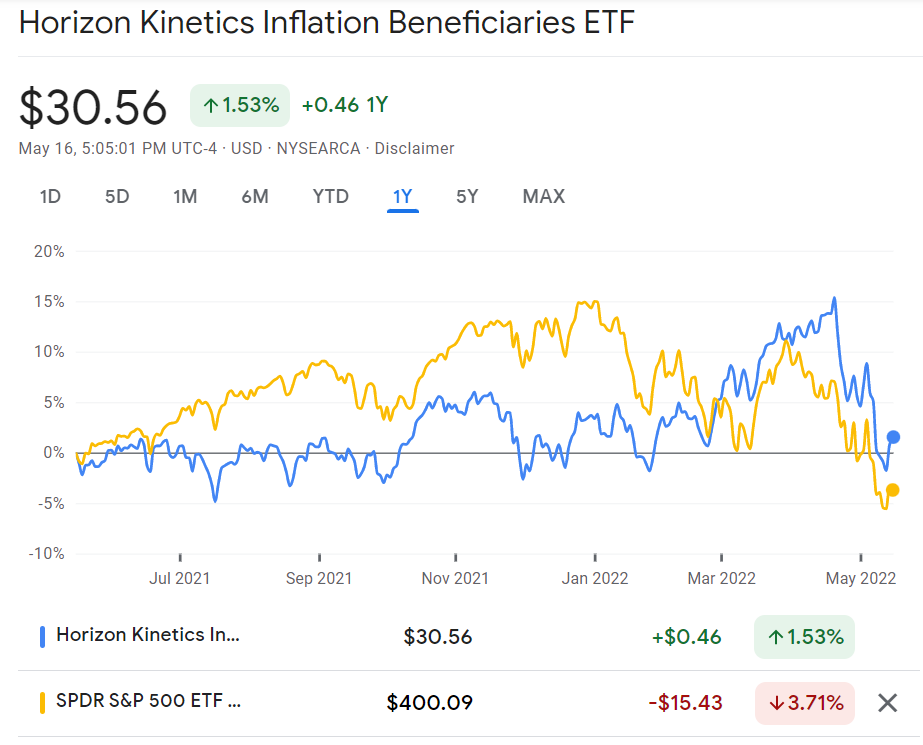

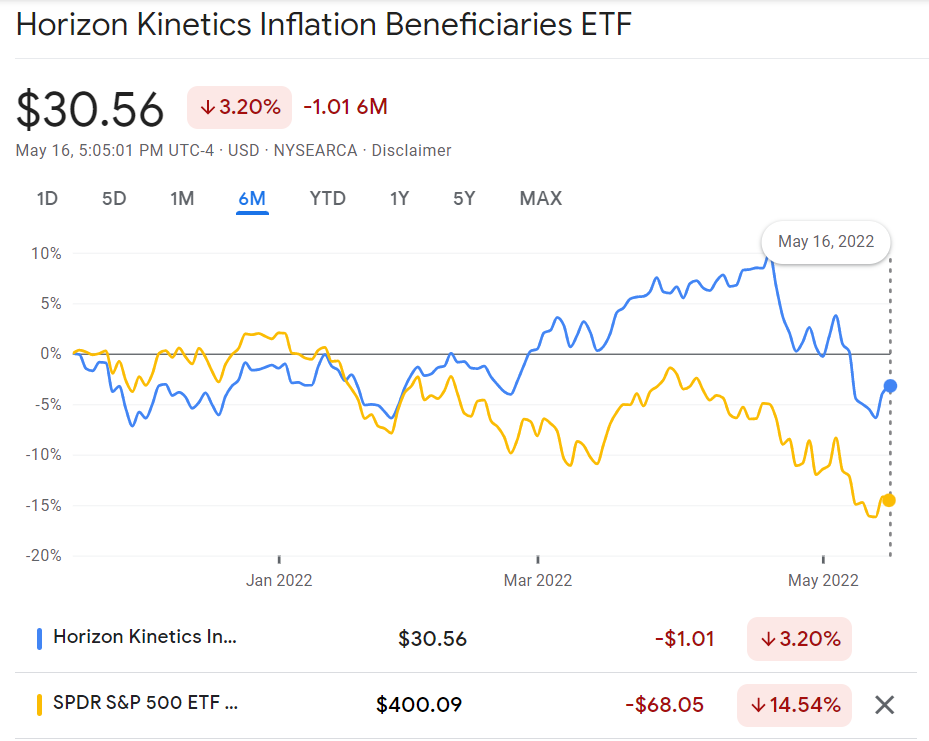

INFL is relatively a new ETF, and thus, the data in google finance is available for a year to compare. INFL compared with SPY over a one-year and six-month period as charts shown below:

Over one year, there is no significant difference in performance compared with SPY. However, over six months, INFL has performed better in drawdown.

I expect INFL not to show outperformance in terms of stock price appreciation; instead, investors can expect a lower drawdown when the S&P 500 or broader market falls.

For more information, risks, and disclosures on INFL — please visit Horizon Kinetics.

FCPI — Fidelity Stocks for Inflation ETF

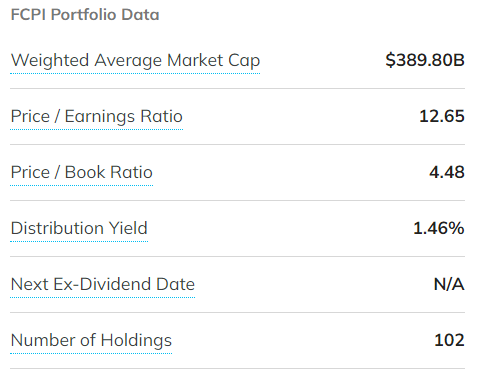

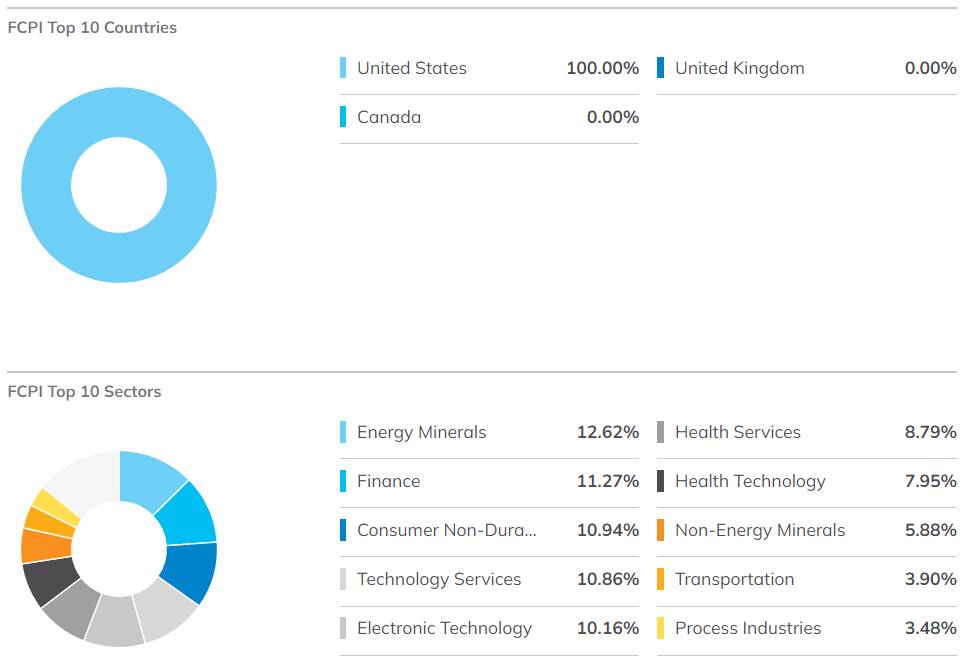

FCPI provides exposure to large- and mid-cap US equities that tend to outperform in inflationary environments. The index starts with the top 1000 US companies by market cap; each is ranked and scored based on value, momentum, and quality factors. The final selection is approximately 100 stocks, based on market cap within each sector. Each stock is equally weighted plus an overweight adjustment depending on its sector. Sectors such as energy, materials, consumer staples, health care, real assets, and infrastructure receive a +5% overweight in the portfolio.

FCPI is appropriate for investors looking for short-term inflation protection.

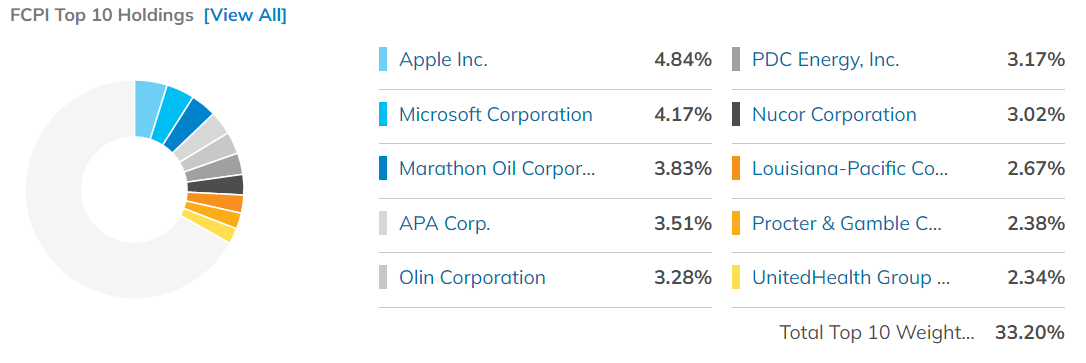

The Top ten holdings account for 33% of the total portfolio.

The Good:

- FCPI is appropriate for investors looking for short-term inflation protection.

- Exposure to US markets only

- Targeted Exposure toward Inflation beneficiaries

- The Fidelity Stocks for Inflation ETF (FCPI) tracks a proprietary index of large- and mid-cap U.S. stocks with attractive valuations, high-quality profiles, and favorable price momentum, emphasizing industries that tend to outperform inflationary environments.

5. Exposure to the US markets only — in contrast to INFL, which offers global developed economic exposure.

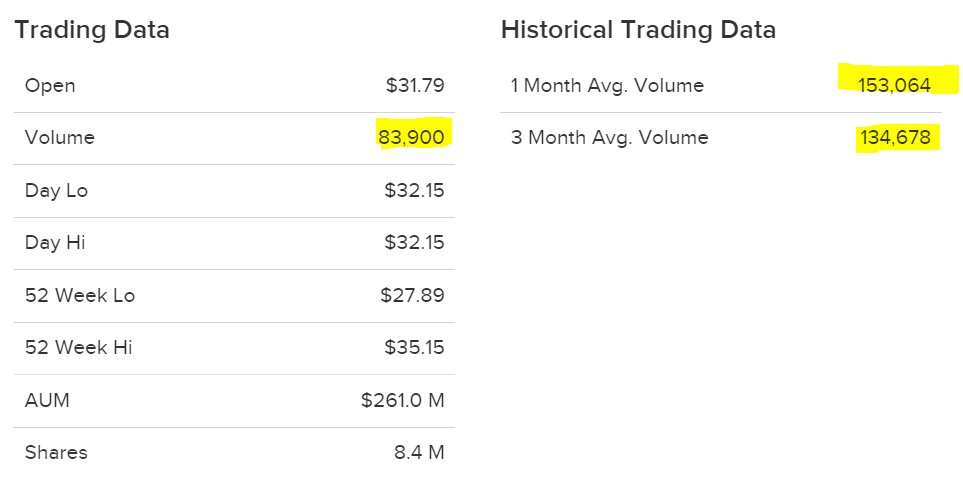

6. With the total number of holdings at 102 (a less concentrated portfolio than INFL), the ETF yields 1.46% (based on the current market price).

7. The ETF holds large and mid-caps — and thus, may experience lower volatility than INFL

The Bad:

- The ETF was incepted on 11-May-2019 — The fund has a limited history, only a few years. Thus, investors have to know that FCPI ETF may not be a BUY & HOLD forever and may come in handy during periods of high inflation.

- The expense ratio is 0.29% — meaning investors will pay $29 annually as a management fee for every $10,000 invested. Personally — I feel the expense of 0.29% is moderate when compared with INFL which demands a 0.89% for an inflation play.

- The total volume traded is relatively low, and there might be liquidity risk. Hopefully, the volumes will pick up as the ETF gains popularity in the coming months.

Performance:

FCPI is relatively a new ETF, and thus, the data in google finance is available for a couple of years to compare. FCPI compared with SPY over a one-year and six-month period as charts shown below:

Over a one-year period, FCPI has outperformed the SPY and has delivered a 10% positive return. However, SPY has corrected by 14% over six months, whereas FCPI experienced a lower drawdown.

I expect FCPI to show a combination of stock price appreciation and lower drawdowns during inflationary periods. For more information, risks, and disclosures on FCPI— please visit Fidelity.

FCPI vs. INFL — The Verdict:

Comparing FCPI and INFL (assuming no other asset class is considered for comparison), investors have to understand that these ETFs are to be used only during periods of high inflation and one has to understand the risks and nuances if investing for the long-term.

FCPI has the least expense ratio with a slightly higher yield; delivering a better one-year performance will conclude that FCPI is a better hedge for inflation protection.

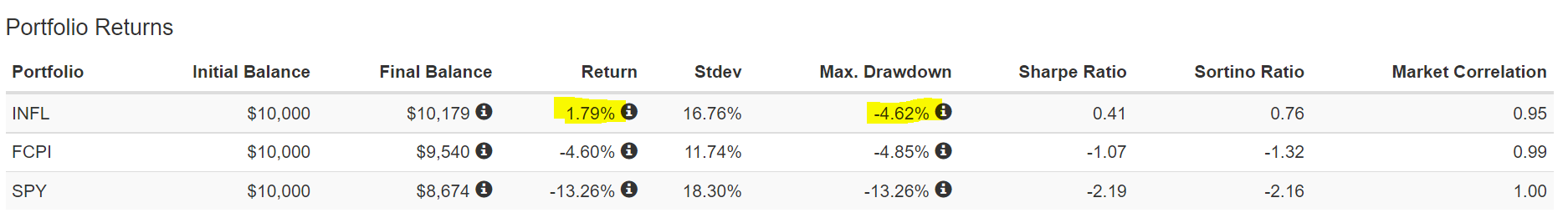

However, with a limited track record of less than a year, we could test INFL, FCPI, and SPY. Based on the limited data available, investors can witness that INFL outperformed by delivering positive returns and demonstrating minimal drawdown.

Between FCPI & INFL, my preference is to opt for FCPI (despite the higher drawdown compared with INFL).

Why?

Because:

- Lower expense ratio

- Large & Mid-cap US securities offer stability

- Tech sector exposure in FCPI will help in the transition from high inflation to other factors

My Investment Choice:

To hedge my portfolio against inflation, I have personally invested in the below-listed ETFs and have neither opted for FCPI nor INFL.

My Inflation protection ETFs:

IAU — Gold ETF

Please feel free to read the data-driven approach to hedge against inflation.

I hope this was useful, and do your due diligence if or when placing a trade/investing. All ideas stated here are my own and do not represent trading or investment advice.