How to hedge your portfolio when stocks, bonds, and cryptos are getting crushed?

We are on the verge of a global recession, as pronounced by most economists, and the stock indices of most countries have corrected by at the least 10% ~ 15%. I have to admit that this is the first time most of us are experiencing the market turmoil where stocks, bonds, and cryptos are getting crushed. Sky-high inflation along with supply constraints are driving commodity prices high. With all that being said, how to hedge your portfolio?

Here are some data-driven ways to hedge your portfolio without using the complexity of options and derivatives.

Holding on to S&P 500 ETFs like VOO and averaging it is what most people do, and I have been doing the same. However, during this correction, I wanted to find momentum in the markets.

There is always a bull market like a Sun and sunshine somewhere.

We built an analytical tool at WIBE to find that bull to ride along with it.

Did we find it?

Yes.

How?

For discussion, let’s assume that we do not understand inflation, geopolitical crisis, FED interest rates, etc. All we have is some analytical tool that runs on an algorithm (based on mathematics and statistics along with technical indicators). The tool tells us that S&P 500 has been entirely out of sync with these sectors for over two to three months. We observed the stocks in these sectors, and they were flying as high as rockets.

Without much further ado, let’s reveal the bulls!

The bulls in the current markets are:

Energy,

Utilities,

Consumer Staples, &

Healthcare.

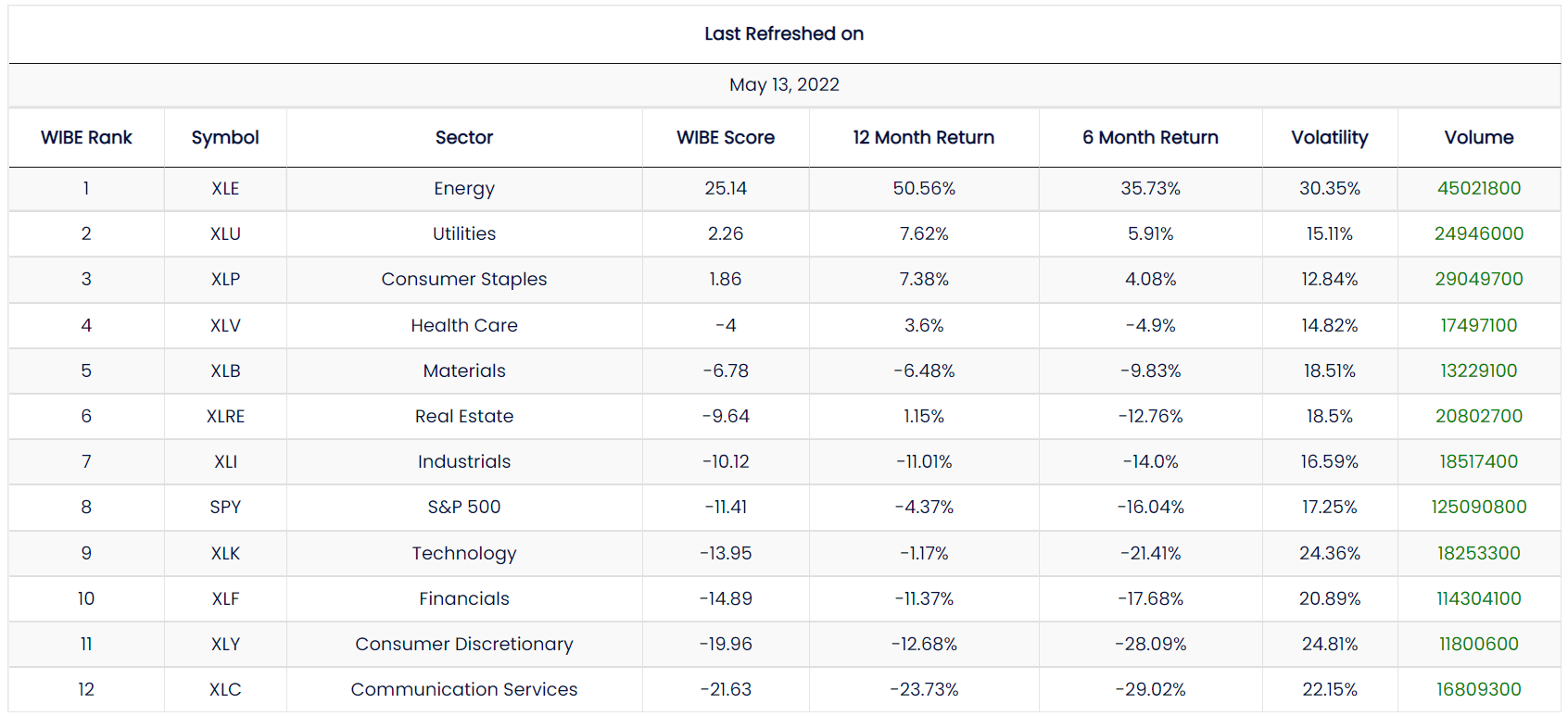

From the above image, as you can see, the S&P 500 (the index) is ranked eight (WIBE rank). For simplicity of presentation, we have removed the technical indicators and presented some critical data. The WIBE score for the energy sector is far higher than other sectors indicating extremely bullish momentum. Next comes the utility sector, consumer staples, and the Healthcare sector, which are bullish. I prefer to invest in the sectors rather than individual stocks, and as of today, I am vested in:

XLE — Energy Sector

XLU — Utility Sector

XLP — Consumer Staples Sector

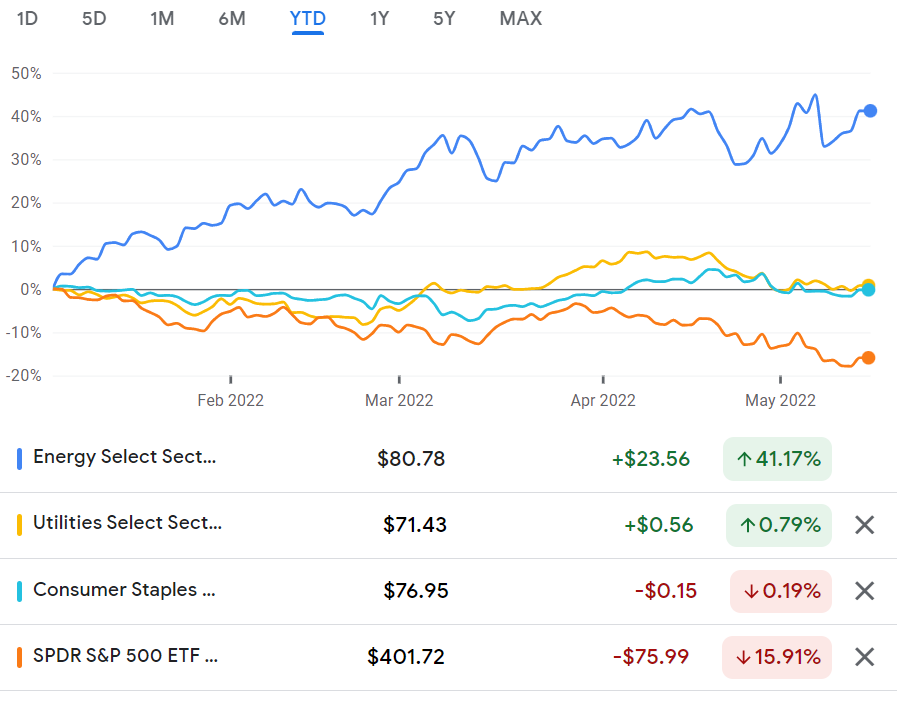

All three sectors have a positive WIBE score and have outperformed the S&P 500. The below image shows the sector’s outperformance when compared with the S&P 500

In one of my previous articles, I have explained why these sectors outperform the S&P 500 — and feel free to read it here.

Are there any other ways to hedge your portfolio?

Yes.

This is where our platform WIBE comes in handy with an exciting and actionable analytics section. We have an area under analytics where we track the global macroeconomics and compute the WIBE score to find where the smart money is moving.

As you can see from the above image (technical indicators to BUY/SELL each ETF are hidden for simplicity of explanation), the top 15 ranked countries based on the WIBE score were Qatar, Saudi, and UAE ranked top three, while the US market (S&P 500) is ranked 23. With oil and gas prices soaring high, no wonder the middle-eastern countries are gaining the benefit. Saudi Aramco reported a more than 80% jump in profits, further boosting the KSA ETF.

At WIBE, we track about 50 different economies and rank them based on WIBE scores with clear BUY & SELL signals. These Buy & Sell signals enable traders and investors to save time and effort and confidently enter positions.

The next question — When to sell these ETFs?

Most blogs recommend buying or time the entry and never care to let you know when to exit. It is essential to have straightforward entry and exit strategies with momentum or any trading strategy.

Exit Strategy: When tech stocks or S&P 500 ranking as per WIBE Ranks comes closer to XLU / XLE (or) XLU/XLE momentum fades, we will book profits and exit the position → re-invest the proceeds into S&P 500.

I hope this was useful, and do your due diligence if or when placing a trade/investing. All ideas stated here are my own and do not represent trading or investment advice.