We love building analytical tools that enable us to empower our personal investment decisions and thus born WIBE, a platform for momentum investing & trading.

I am sure most of you are bleeding like I do, as the markets are correcting in these last few weeks. Holding on to S&P 500 ETFs (like VOO) and averaging it is what most people do, and I have been doing the same. However, during this correction, I wanted to find momentum in the markets.

There is always a bull market like a Sun and sunshine somewhere.

We built an analytical tool at WIBE to find that bull to ride along with it.

Did we find it?

Yes.

How?

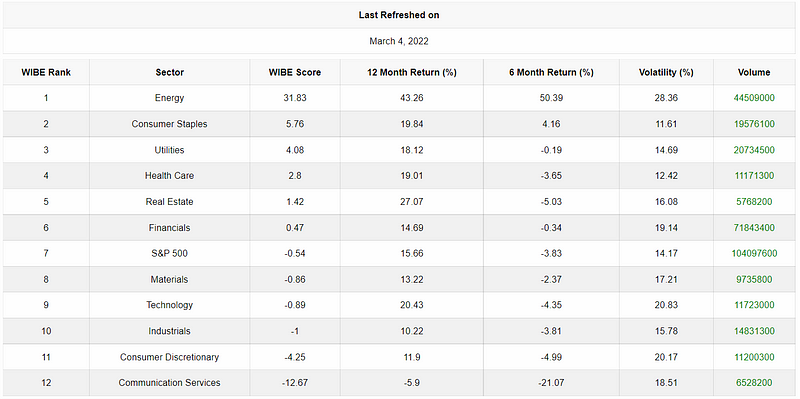

For discussion, let’s assume that we do not understand inflation, geopolitical crisis, FED interest rates, etc. All we have is some analytical tool that runs on an algorithm (based on mathematics and statistics along with technical indicators). The tool tells us that S&P 500 has been entirely out of sync with these sectors for over two to three months. We observed the stocks in these sectors flying as high as rockets.

Without much further ado, let’s reveal the bulls!

The bulls in the current markets are:

Gold

Energy, &

Utilities

Why did these sectors outperform S&P 500?

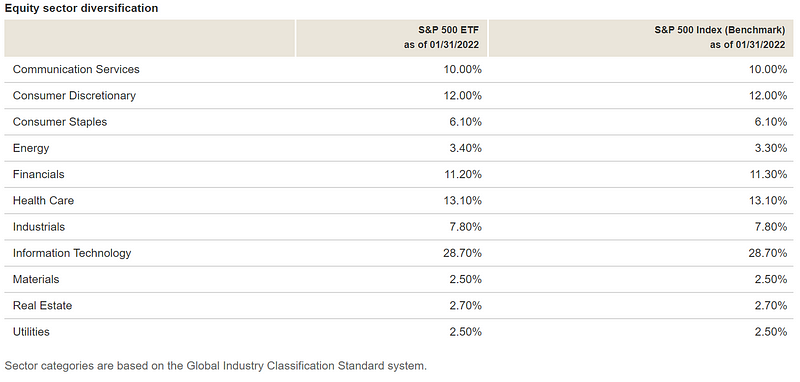

We have to refer to the S&P 500 sector break-up and % allocation towards its constituents to understand this.

About Vanguard S&P 500 ETF (VOO):

Sectors with Allocation less than 5%:

- Utilities

- Materials

- Real Estate

- Energy

Sectors with Allocation in between 5% to 10%:

- Consumer Staples

- Industrials

The highest Allocation at 28.7% is for Information Technology.

I am sure this must clarify why the tech stocks have a more significant influence on the S&P 500 index and why defensive sectors like Utilities, Materials, Real Estate, and Energy have minimal effect.

There is nothing wrong with buying S&P 500 and sitting over it for decades. However, a little bit of work tracking sector rotation will help identify where the “smart money” is being deployed.

Momentum Investing or Trading is nothing but riding the trends following the smart money. Even when the market crashes, tracking smart money will help get some clues to ride the trends.

Thus, we invested in Energy ETF (XLE) and Utilities (XLU) which, along with Gold (IAU), are the only ETFs that have delivered positive returns.

Let’s explore XLE charts:

Based on the monthly charts, we can see two significant resistances until XLE’s all-time high price. We can expect that if the bulls continue to run, there is an upside potential of 15% to 30% to reach its all-time high price.

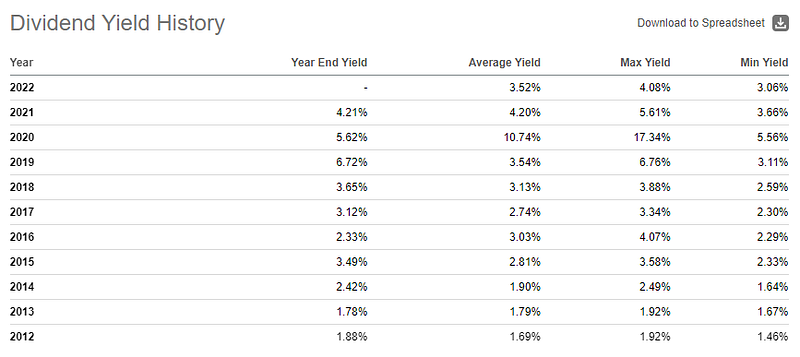

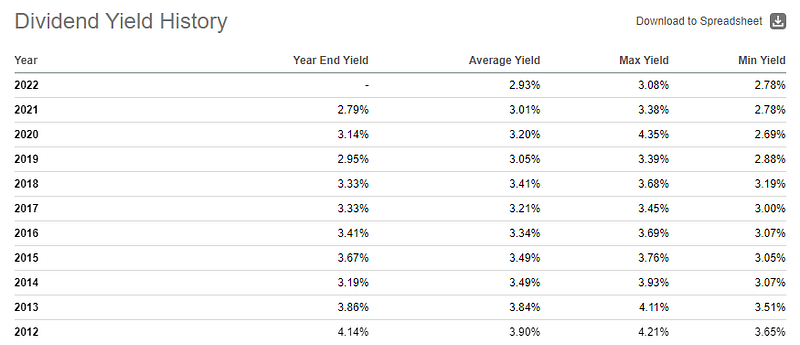

XLE also pays an excellent dividend yield of a little over 3%, an additional benefit. From the below table, one can see that the dividend yield (when the market crashed in 2020 — yield went high when prices went down) in 2020 was about 10%, which is too juicy to resist!

Let’s explore XLU charts:

Based on the weekly charts of XLU, the price is close to all-time high price or pre-covid levels. With

- High inflation,

- The expected interest rate increase,

- With high energy costs due to high oil and gas prices, the utility sector is likely to have a good run.

XLU also pays a nice dividend yielding a little less than 3%, an additional benefit.

Most blogs recommend buying or time the entry and never care to let you know when to exit. It is essential to have straightforward entry and exit strategies with momentum or any trading strategy.

Bonus: 8 Killer Steps that Make You a Successful Stock Trader

Exit Strategy: When tech stocks or S&P 500 ranking as per WIBE Ranks comes closer to XLU / XLE (or) XLU/XLE momentum fades, we will book profits and exit the position → re-invest the proceeds into S&P 500.

I hope you liked the trades and explanation. Do share your thoughts on this trading strategy or any advanced techniques.

Do your due diligence if or when placing a trade. All ideas stated here are my own and do not represent trading or investment advice.