What to do when Gold outperforms S&P 500?

If you have been following my soccer portfolio, and from the time I bought Gold (IAU), the price has appreciated drastically and most of which appreciated in the last month, which is obviously due to many factors, including but not limited to:

The geopolitical situation between Russia-Ukraine,

High inflation,

Commodities bull run, and

The expected increase in interest rates.

Gold (IAU) in the last year:

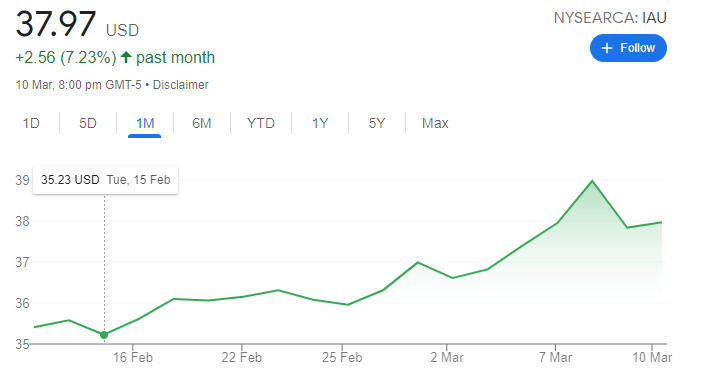

Gold (IAU) in the last month:

I am not sure whether the price will continue to increase further — but let’s look into the charts of IAU. Monthly charts of IAU reveal a beautiful cup & handle formation indicating a break-out to its all-time high price.

In the last two trading days, the price had hit the all-time high price and recessed back, and it is worth watching if the price cross beyond $39.6

Before I proceed to explain my portfolio rebalancing – A quick reminder:

The goal of my soccer portfolio is

1. Aimed to beat inflation

2. Long-term wealth creation

3. Ultra-passive

4. Low-churn

5. Well-diversified

6. All weather portfolio

I call it a Soccer Team Portfolio, and this is a series of articles where I pick players and build my team who play the game of investing. Note that this is an actual portfolio, and I request the readers to read the disclaimer before following this portfolio. Following is at your own risk.

Summary:

Goal Keeper: Cash

Center Midfield: VOO

Left Midfield: IEMG

Right Midfield: VBK / VBR

Center Back #1: BND

Center Back #2: IAU — Gold

GOLD & VOO Divergence:

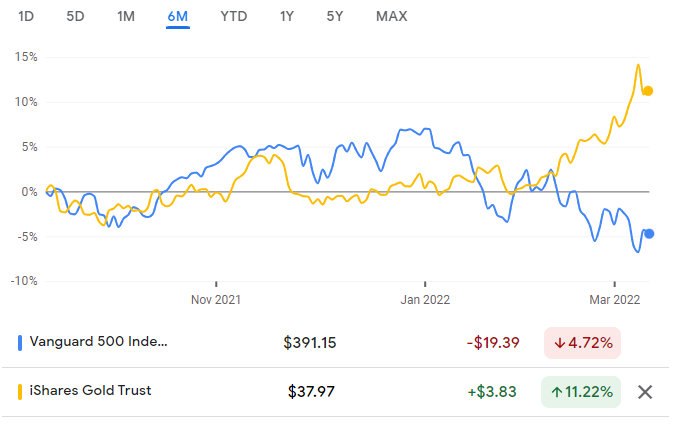

The chart above compares Gold (IAU) and S&P 500 (VOO ETF), where Gold has outperformed the S&P 500 (almost twice the returns). This scenario is not common and does occur only when there are some uncertainties in the markets or higher volatility.

The chart above compares Gold (IAU) and VOO for the last six months period where VOO was down by 4.7% whereas Gold was a positive 11.2%.

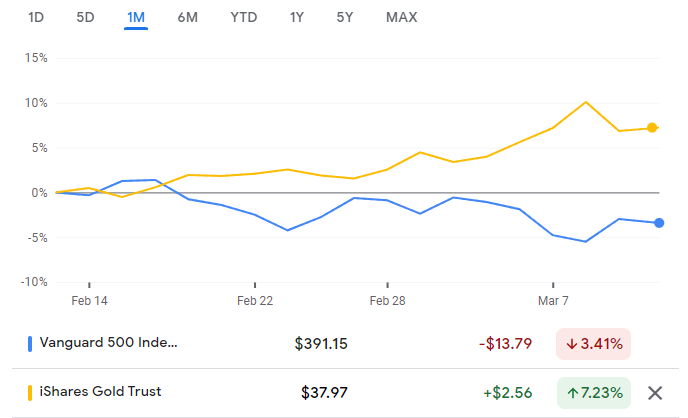

When compared for the last month, Gold exhibits divergence with respect to VOO.

So what does it mean to investors?

Usually, VOO or the S&P 500 index will outperform Gold’s returns. However, during times of high volatility and uncertainties, Gold beats the S&P 500 — meaning, people are looking for safe assets than risky assets (equities).

When Gold starts to outperform S&P 500, there are two ways to deal with the situation.

Allow the Gold to continue its run (it may go higher or drop)

Rebalance the portfolio (book profits from Gold’s excess returns) and keep % allocation towards Gold steady. One may consider having a set point as 10% or 15% as a rebalance trigger.

In the case of our soccer portfolio, I have rebalanced the excess returns at 15% from the price levels that I invested, and the proceeds have been invested in VEA (Vanguard Developed Markets ETF). Depending on your portfolio % allocation, you may also consider investing in the S&P 500 (VOO).

Rationale:

Gold (IAU) will ever be part of the soccer portfolio, and thus, after rebalancing, I am not worried about any drop in the price of Gold as I am prepared to hold it forever. However, on the contrary, if the price of Gold continues to increase further, at again 15% trigger, I will book some profits and invest in VOO or as required back in the soccer portfolio.

Mode of Investments in Gold:

Mode of investments in Gold (either in physical form or in Sovereign Gold Bonds in India) matters a lot when rebalancing. one must be aware that liquidity has to be compromised if invested in physical Gold or SGBs. Whereas investing in ETFs like IAU / GLD or GoldBeES offers returns similar to Gold but with liquidity in your hands. Thus, investing in Gold is not for everyone, and in fact, allocation to Gold is not essential.

One should also be mindful of taxation when selling any asset class. Countries like Hong Kong, Singapore, and Dubai have no capital gain taxes (When writing this blog, and subject to change anytime – please consult local financial planners for more details).

I hope this article was helpful, and do subscribe for more updates as I build my soccer portfolio.

Feel free to share your thoughts and ideas in the comments.