Two Types of Income that will make you RICH!

Everyone wants to become wealthy! Just that people are not financially aware of becoming rich.

There are many articles and multiple books on financial freedom, investing, and wealth creation. Yet, there is still something amiss that prevents people from becoming wealthy. Let’s dig a bit deep and find the key to riches.

Any average joe who is on full-time employment finds it difficult to become wealthy. Not all, but most of them. They are busy with their daily routines and hardly have any time to think about wealth or financial literacy.

In this write-up, let’s discuss a key concept that all the wealthy employ. Let’s start with a monthly paycheck or salary, which the average Joe gets every month in his bank account. Let’s call it ‘Earned Income.’

What Differentiates the Wealthy from others?

Many will call it a wealthy or growth mindset. To me, that’s too bookish or theoretical—a little bit of study on how the wealthy use earned Income revealed something interesting.

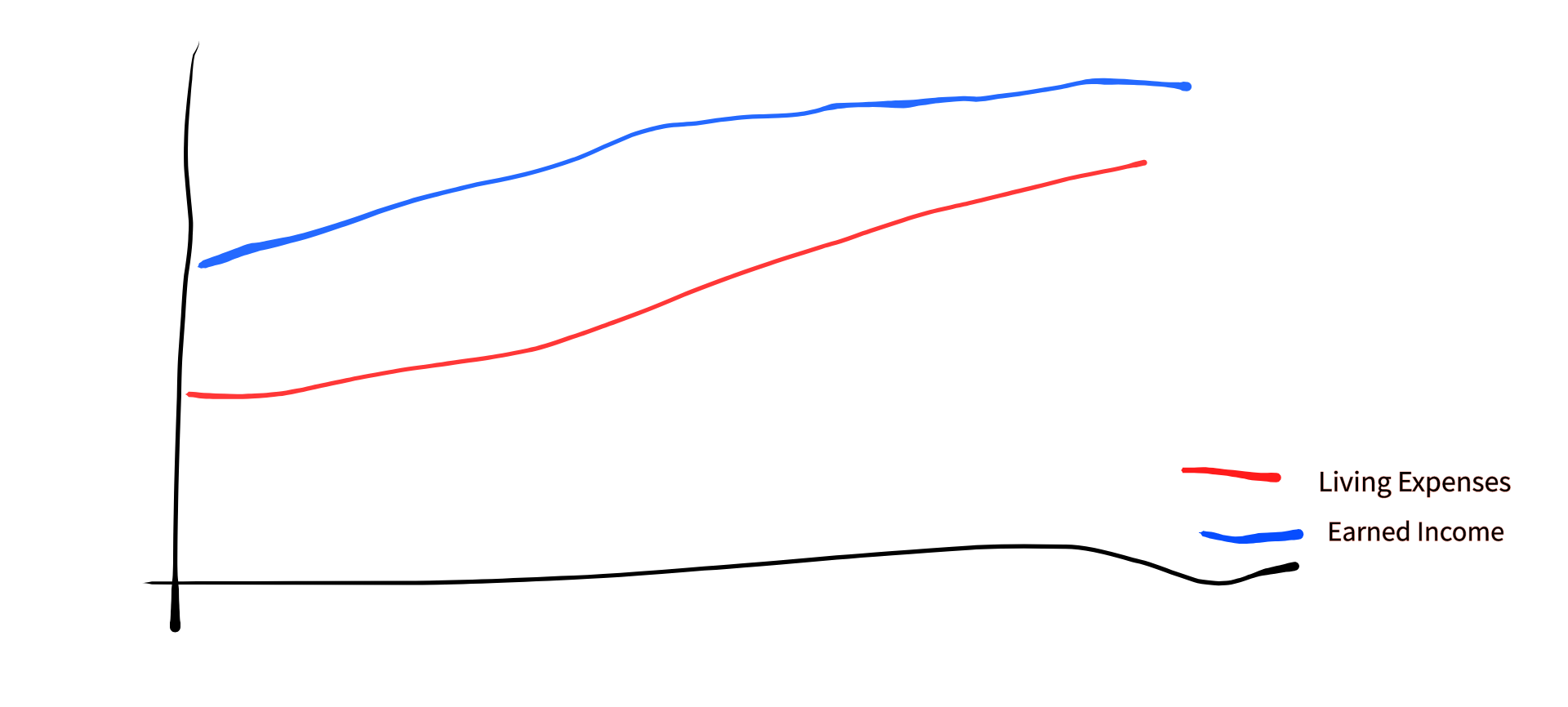

Source: Author’s drawing (not to any scale) — for demonstration only

Your earned Income, in general, is higher than the living expenses (for most of us). As we age, the earned Income hits a plateau, whereas the living expenses continue to creep high. There is scope for investing money if the red line is below the blue line (living expenses lower than earned Income).

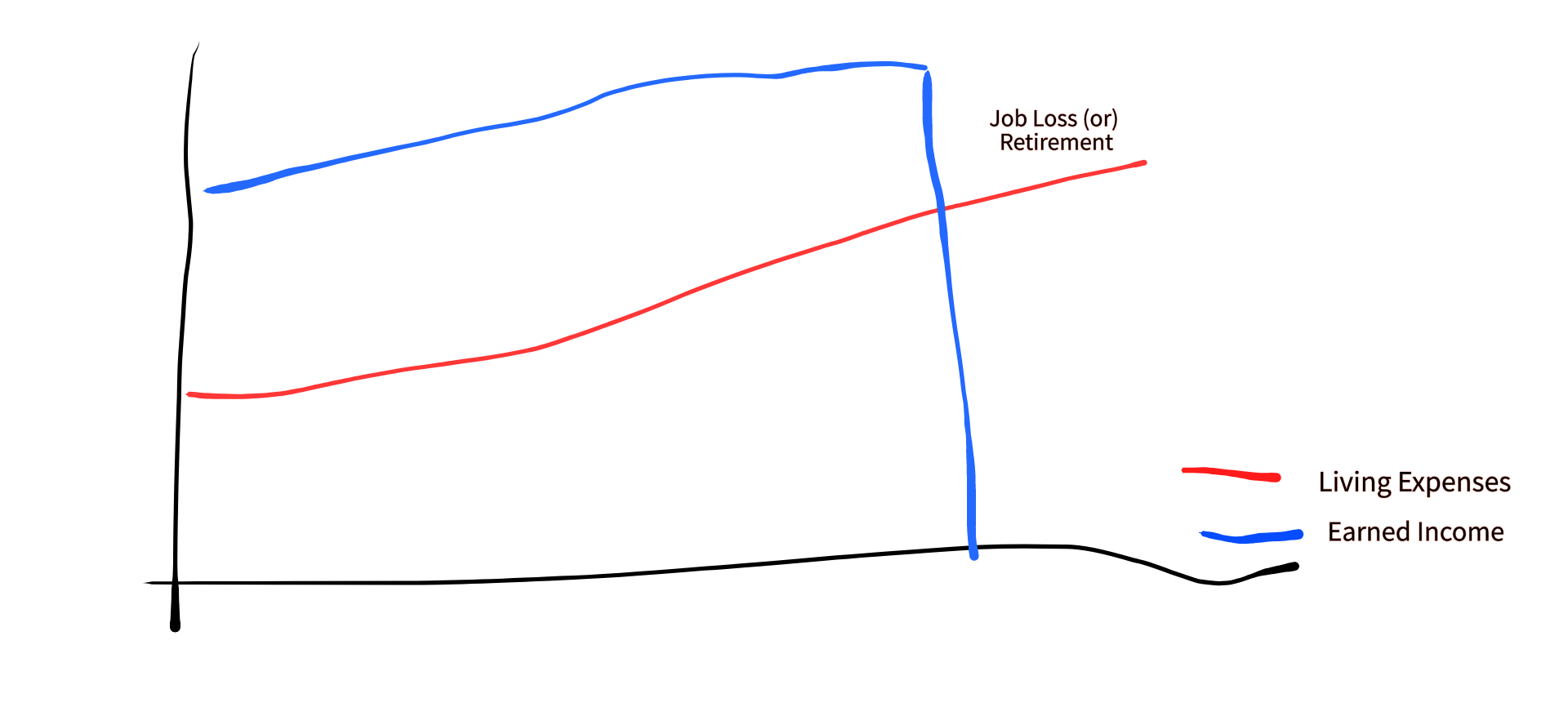

However, the day we are fired or retired, the earned Income abruptly comes to zero. However, the living expenses continue to creep higher.

Source: Author’s drawing (not to any scale) — for demonstration only

Now, let’s focus on critical steps on how to achieve financial independence or abundance.

Source: Author’s drawing (not to any scale) — for demonstration only

The Wealthy focus on two other means of Income, apart from earned Income.

Passive Income, and

Portfolio Income.

The moment a paycheck is received, the wealthy divert a significant part of their Earned Income to passive and portfolio income.

Building passive Income is not that easy and demands enormous upfront hard work, discipline, and heavy capital infusion in the case of tangible assets.

Portfolio Income: can be from a portfolio of stocks, ETFs, or REITs. A significant part of earnings is allocated to a portfolio of assets. Most people will aim to grow their portfolio and allow it to compound over many years. Once the required corpus is achieved, or, in case of retirement, the portfolio is altered to provide regular cash flow.

Source: Author’s drawing (not to any scale) — for demonstration only

With both Passive and portfolio Income flowing in along with earned Income, the total earnings compound over and over, leading to rapid wealth creation. The moment the cash flow from passive and portfolio Income exceeds the living expenses, one can become financially free.

If the cash flow from both passive and portfolio income exceeds both living expenses and the last earned Income, it is almost the stage of financial abundance.

Value for Money,

Or

Money for value?

It is the ability to convert earned Income to a passive (or) portfolio income that differentiates the wealthy from others.

Now, read that again! Elon Musk pays almost negligible tax! He is one of the World’s wealthiest people, who bears an insignificant tax.

Here is the thing — The more portfolio and passive Income you have, the relatively lower the taxes.

Where you Sweat the most → Earned Income → has the highest tax!

Where you Love to sweat →Passive Income → moderate tax!

Where you Don’t sweat → portfolio Income → minimal (or) no taxes as long as you continue to hold.

Take-aways:

- Create Sustainable Passive Income Stream/s

- Create Portfolio Income as early as possible

- Key to Financial Freedom: Income from Passive and Portfolio more than living expenses.

- Key to Financial Abundance: Income from Passive and Portfolio more than earned income.

- Ax the Taxes → As practically possible, convert earned Income to portfolio income and hold it forever!

We hope you found this useful.

Should you have any questions, do write an email to fill up the contact form and we shall revert as soon as possible.