I have been writing a series of articles as I build my soccer team portfolio for wealth creation. In case if you have not read them yet, please feel free to access the list of articles here.

Coming to the emerging markets, I think this is the best time to start investing in emerging markets if you have not done it earlier. My Soccer portfolio — Left Midfielder position played by an emerging markets ETF. Feel free to read the details on why I have picked a particular emerging market ETF below.

Why is it the best time to invest in ‘Emerging Markets?

I have constructed a simple macroeconomic dashboard where I track all developed and emerging markets. I allocate a WIBE Score, a proprietary score based on % returns, GDP, Country’s political and economic outlook, stock volume, volatility, rate of change, and relative strength. In simple terms, the higher the WIBE score, the better is the risk-adjusted returns (or) more robust the country shall perform. The ranking changes every month based on the macroeconomic outlook, and I study them every month or once a quarter.

Here is the updated global macroeconomic dashboard for your reference.

The dashboard shows various countries ranked based on the highest WIBE score to the lowest. In this case, Canada stands first, followed by Russia, India, and the USA, to the last being South Korea. India is the only emerging country in the top ten ranks, and Mexico is another at eleventh rank.

Most emerging market countries have not performed well and are yet to recover from the COVID-19 pandemic. Some Countries to take note of are:

- South Korea (though not classified as an emerging market by Vanguard, but falls under emerging markets when it comes to iShares)

- Brazil

- China / Hong Kong

- Taiwan

- Malaysia

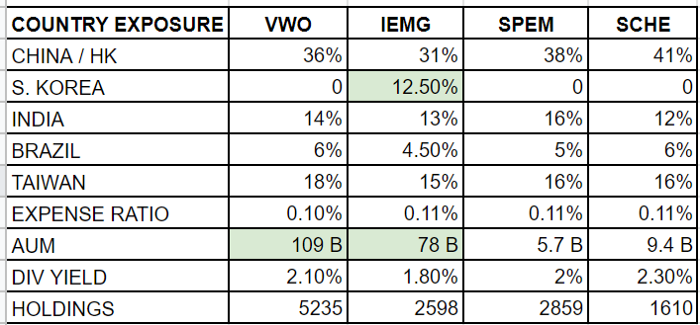

The emerging markets ETF (IEMG) in my Soccer team portfolio constitute about 76% weightage to those countries ranked the lowest in the macroeconomic dashboard. Let’s look at some significant reasons and benefit by staying invested in the emerging markets ETF.

South Korea — Samsung, Hyundai, LG are the top names to look at. South Korea is one of the leading exporters of electronics, cars, and shipbuilding activities.

China/ Hong Kong — Started with the trade war, Edu-tech crackdown, tech-sector crackdown, followed by Evergrade default and what not. Hong Kong and China stocks are likely to see an upside, assuming the worst days are over.

Brazil — not to be missed out on when it comes to the recovery of emerging markets. Political instability, 20% of global freshwater presence, 40% of global known natural resources from the forest, the abundance of iron ore and other minerals.

As the borders are likely to re-open soon, Taiwan / Malaysia/Thailand, and other countries are all set to shoot.

Based on WIBE Macroeconomic dashboard, Hong Kong and China have already started to rebound. With about 30% exposure to China, IEMG may see a potential upward journey assuming India and South Korea stay on track.

I hope this article was helpful, and feel free to share your thoughts and ideas in the comments.

This article is not a buy/sell recommendation and shared for information & knowledge purposes only. The author is not a professional (or) qualified investor, and the articles are not investment advice or a recommendation or advice of any sort. All the analysis/data are from the public domain, like, but not limited to, Yahoo Finance, Google Finance, Investing.com. Consult your financial planner for any investing decisions. This article is not a paid promotion, and the expression in this article is solely the author’s research & analysis. While anyone can give a stock “BUY” recommendation, investors must have a strategy in place and know when to “SELL” a position.