When it comes to the stock market, commodities, or any other asset class, there exists two major market participants:

- Traders,

- Investors.

Of course, the third category is those speculators, and the write-up is neither for them nor about them.

Both Trading & Investing are profitable as long as the skill and the required mindset are regularly honed. In this write-up, let’s look to understand the difference between trading and investing.

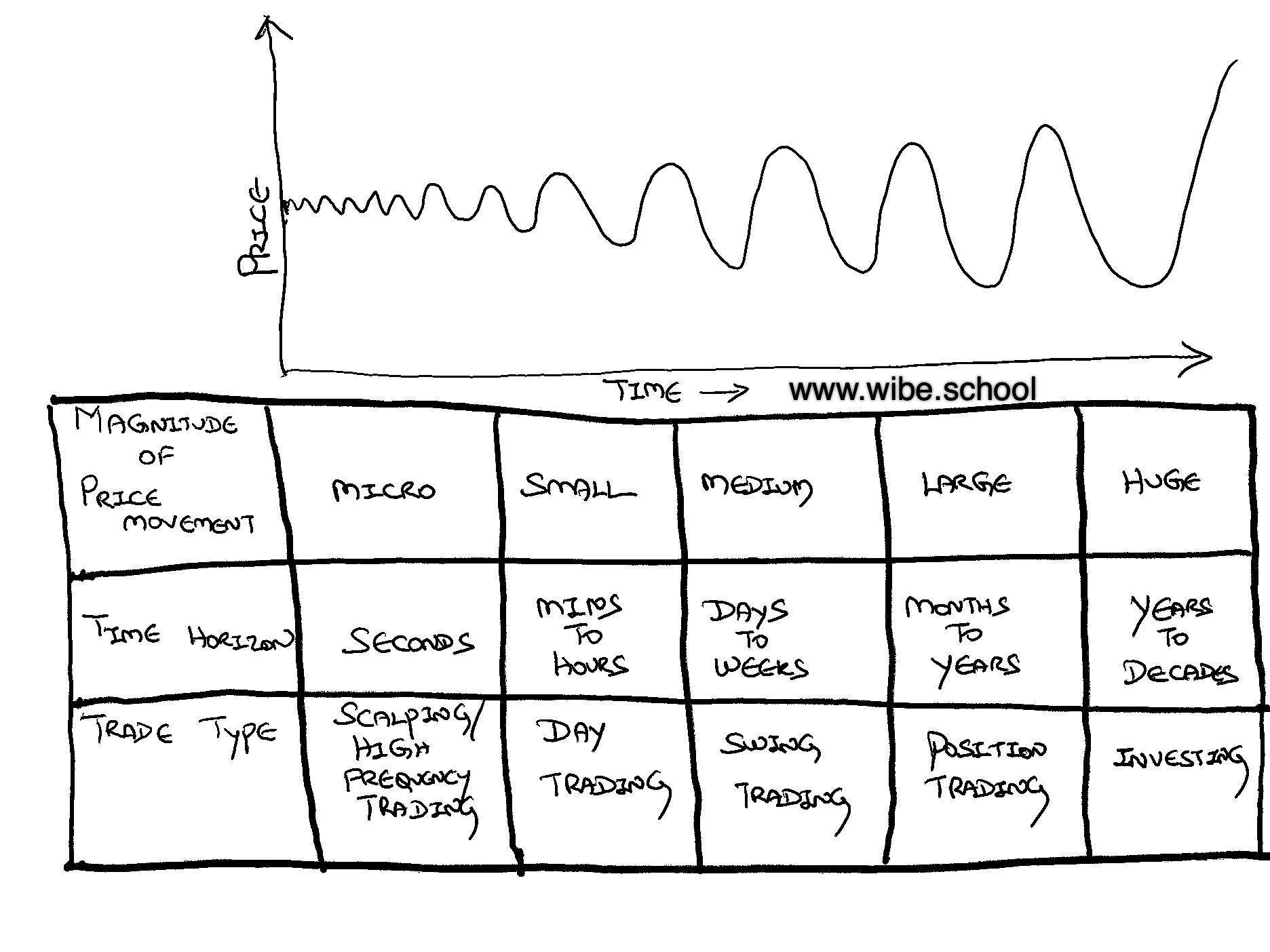

Difference between trading and investing arises due to the time frame of the assets or positions held. It could be anything from a few hours and then days, months, years, or even a few decades.

Let’s take a real estate property as an example. Most Investors hold real assets over a few years, if not some decades. None will flip a property within a few hours or days, as is the case for stocks or other digital assets.

Timeframes:

Scalping & High-Frequency Trades:

High-frequency trading or manual scalping is usually done within a few seconds to minutes and is probably a high-risk strategy if not equipped with live data feeds and direct broker access. Scalping is based on assuming that most stocks will complete the first movement stage. But where it goes from there is uncertain. After that initial stage, some stocks cease to advance, while others continue advancing. Scalping is to be executed if we have a clear profit target contrary to other trading or investing styles where the profits are let to run. A series of minimal gains aggregate over time to make it high enough, but enormous stress and effort are equally required to sustain such gains.

Day Trading:

Simply put, day trading is flipping assets within the same day to secure minuscule profits. Day traders buy a stock anticipating an increase or decrease in asset price, relying on technical indicators to profit in the short term. Once the profit targets are achieved, the positions are squared-off to walk away with the profits. It is highly debatable how many trades turn out profitable and how consistent such profits are. Day trading requires a high skill set, and it is not easy to profit consistently.

Day trading is when you buy and sell stocks within the same day, keeping no positions open overnight. Usually, day trading involves highly volatile assets. Meaning traders look to buy and sell assets with a lot of price movement and high liquidity. Because the assets you trade in day trading can often have quick price movements, it is vital to have a clear and defined strategy before you start trading.

Usually, it is recommended to focus on one asset at a time. Day trading will allow you to track the progress of the asset in more detail. Day trading may involve watching/ reading the news and being aware of any events related to the asset or sector of interest. All these things need to be tracked closely to have a successful day trading experience.

Swing Trading:

Swing Trading theoretically implies buying assets and holding them for several days to a few weeks or months. Swing Traders usually come out with clear entry points, await trade confirmation signals, exit points for profit booking, or let the position ride if the trend continues to be favorable.

Swing trading is a method of trading where assets are bought and sold not within a matter of a day but rather a matter of days, weeks, or even months. Although usually, if an asset is held for more than a year, it would be considered an investment strategy rather than swing trading. This way of trading usually relies on gains over an extended period.

The most popular choices for swing trading in terms of assets are assets with significant capital. These could be stocks with a market capitalization of over $10 billion, and in most cases, maybe a blue-chip stock or an ETF. These assets are suitable for swing traders because they are usually less volatile and have fewer dramatic price jumps.

Position Trading:

Position trading is buying and holding assets from a few weeks to several months, but usually less than a year. Position traders typically follow trends or trending stocks, take a position when an asset starts trending, and exit the position when the trend reverses direction. Most position traders rely on technical indicators, and a few combine fundamental and technical analysis before taking a position.

One will appreciate that position trading is the only trading style with the most extended holding time frame amongst trading styles. It is generally a blend of trading and investing, only a thin line separating them.

Position traders are trend followers. They identify a trend and an investment that will benefit from it, then buy and hold the investment until the trend peaks. The successful position trader identifies the correct entry and exit prices in advance and controls risk using stop-loss orders.

Investing:

Investors buy and hold securities or assets for years and some even decades. One of my favorites is Warren Buffett, who is acclaimed as one of the greatest investors of all time. Warren is known for his ‘Value-Investing’ style, where the securities are bought under-valued and held for years.

Investors generally wait out short-term losses or volatility and enjoy dividends, growth, and long-term wealth creation. While markets inevitably fluctuate, investors will “ride out” the downtrends with the expectation that prices will rebound and any losses eventually will be recovered. Investors typically are more concerned with market fundamentals, such as price-to-earnings ratios and management forecasts. The goal of investing is to gradually build wealth over an extended period by buying and holding a portfolio of stocks, baskets of stocks, mutual funds, bonds, and other investment instruments. Investors often enhance their profits through compounding or reinvesting any profits and dividends into additional shares of stock.

Similar to trading style and strategies, Investing comes with two main formats:

- Passive or Indexing,

- Active Stock picks

Further, within active stock picks, there are multiple styles like, but not limited to:

- Value Investing

- Growth Investing

- Income Investing

- Dividend Investing

- Contrarian Investing

- Smart Alpha / Beta Investing — like Momentum, Low Volatility, and combination of factors

To Summarize, both trading and investing are profitable. The only difference is the time an asset is being held. Investing is far more beneficial for retail investors, whereas those who are experienced and equipped with proper tools to scalp trade are also equally successful. Simply put, trading is to make money, and investing is for wealth creation.

Thanks for reading and we hope you found this useful. Should you have any questions, do get in touch or send us an email or contact form and we shall respond to you soon!

Happy Trading / Investing!