Here are my stock trade/set-up explanations with charts!

About 80% of retail investors lose money when trading stocks. This massive challenge is yet to be solved in the purview of retail investors despite numerous FinTech advancements. There exists an enormous gap between financial literacy and portfolio returns.

We launched WIBE to enable investors to achieve consistent & profitable trades. WIBE is powered by its cutting-edge algorithm, which is purely based on mathematics & statistics.

Trade Executed: 29-April-2022

Company: HDFC Life Insurance Company Ltd

Stock Ticker: HDFCLIFE

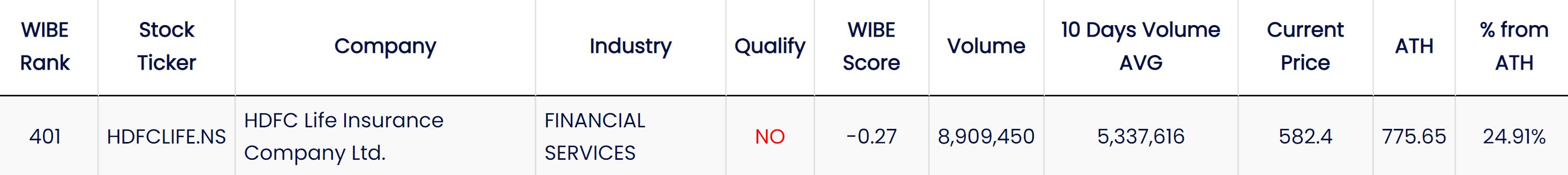

HDFC LIFE is about 25% lower than its all-time-high price of INR 775, according to the WIBE momentum dashboard. HDFC Life is ranked 401 on stock momentum based on technical indicators — meaning 400 stocks perform better than HDFC Life. Daily volume was higher than the ten days average volume.

% From All-Time-High Price:

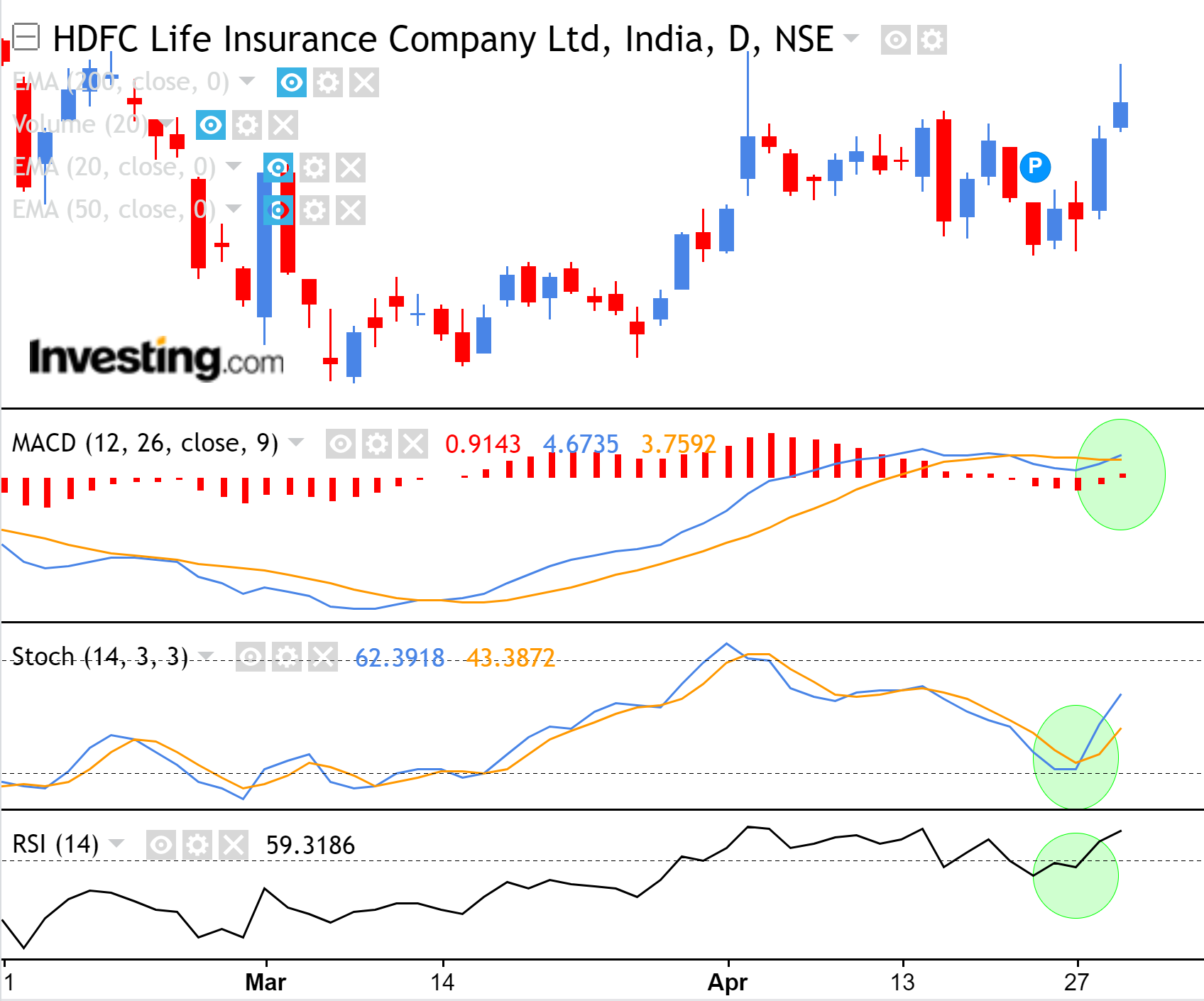

Let’s look at the charts — Technical Analysis:

HDFC LIFE is trading about 6.5% below the 200 EMA. The stock has been at an overall downtrend from late 2021 to 2022.

In general, I prefer not to trade any stock whose price is below the 200 EMA and when the WIBE rank is more than 250 (for swing trading). I believe the downtrend has reversed, and the stock will come up to 200 EMA, which offers an opportunity to pocket a 6.5%.

If the market participants continue to buy, the momentum may increase further, opening up an opportunity to pocket a 9% profit until the next resistance, at INR 634.

With a Risk/Reward at three and a respective stop-loss at about 3%, I believe HDFC Life offers an opportunity with an upside potential of about 9%.

MACD, Stochastics, and RSI all indicate bullish momentum. The volumes shot up after the earnings call today, showing market participation and interest in the stock.

With a Risk/Reward at three and a respective stop-loss at about 3%, I believe HDFC Life offers an opportunity with an upside potential of about 9%, and I will continue to ride the swing until the WIBE indicator becomes Bearish. At any point in time, due to market volatility, if the WIBE indicator turns bearish or the stop-loss activates, I will exit the trade and continue to look for another opportunity.

Note: Markets are highly volatile and, thus, trade with caution. Keep a close watch on trade positions and do not exceed the number of positions. At any given point in time, I will limit the active positions to a maximum of 10. Do not forget to tighten your stop loss as the stock moves up with momentum.

I hope you liked the trade explanation.

#HDFCLIFE #HDFC #Momentumtrade #swingtrading #stocktrading

Do your due diligence if or when placing a trade. All ideas stated here are my own and do not represent trading or investment advice.

Disclaimer: This is not a buy/sell recommendation and is shared for information & knowledge only. The author is not a professional (or) qualified investor, and the articles are not investment advice or a recommendation or advice of any sort. All the analysis/data are from the public domain, like, but not limited to, Yahoo Finance, Google Finance, and Investing.com. Consult your financial planner for any investing decisions. This article is not a paid promotion, and the expression in this article is solely the author’s research & analysis. While anyone can give a stock “BUY” recommendation, investors must have a strategy and know when to “SELL” a position. Do your due diligence before trade execution, and everything is at your own risk.