Why is this the Best Time to Build Generational Wealth?

March 2020 — the market crash due to COVID-19 is still afresh in the memory of most retail investors. However, the market’s recovery post the crash stunned many, leaving a ‘scar’ in their hearts on the missed opportunity. Some even felt they were late to the party by investing in late 2021 only to witness the current market corrections.

Now, people have to realize that there is hardly anyone who did not bear the pain of losses and just enjoyed the rally. I was fully invested during the COVID-19 crash (as per my asset allocation 60:40 — equity: debt), and the markets crashed before even I could wake up from sleep. The only thing that I was able to do was to move more funds from debt to equity to maintain the asset allocation ratio. The post-crash rally surprised me, and I had to rebalance the portfolio by moving some part of equity to debt at least a couple of times.

What stays afresh in investors’ minds is the euphoria of the post-crash rally and not the pain of the COVID-19 market crash.

With that in mind, investors expect a sharp recovery (so-called ‘V-Shape’) and pin their hopes on the markets. They fail to note that this is not a crash but a slow poison that will demolish the last hope of the retail market participant anticipating a market recovery.

The Media is filled with news and analysis that everyone is trying to predict and, in reality, no one knows — even the most prominent hedge fund managers. The sole aim of the fund managers is to make money, and they are making a killer as long as the markets are volatile, like now.

Predicting the Markets:

Everyone can predict the markets, but that depends on what timeline they expect — for example, over decades, anyone can say that the markets will be higher than where we are today. The complication arises only when the prediction timeframe shortens — no one can expect what it will be in the next month or six months.

The FED is looking at more QT or increase in interest rates, with inflation still prevailing at high levels and what is more surprising is the tech. Companies and start-ups are laying off like never before. All these pointers are leading to a full-blown recession around the corner.

Here is my Macro view and Prediction:

Here is my simple analogy to understand the current market macroeconomics.

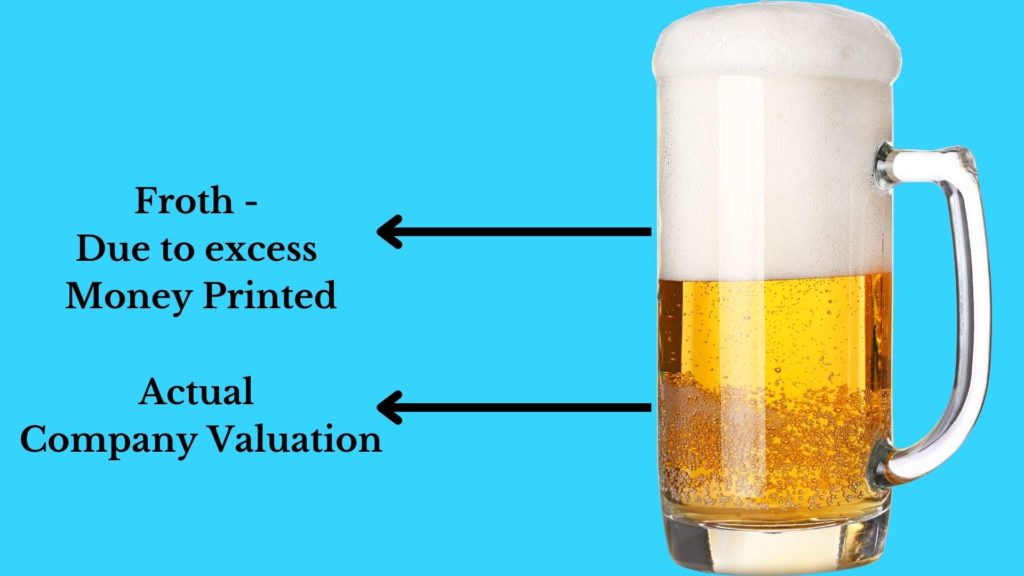

Imagine that you go to a bar and order a glass of beer. The waitress fills the glass of beer with comes the froth. One can never eliminate the froth from the beer.

FED’s printing of money is the froth, and the beer is the actual valuation of the companies (earnings). When FED printed more money, there was excess froth over the beer with a lot of effervescence, making it more attractive to others. Many people started buying the same beer with the extra froth assuming the beer would be tasty.

And now, the party is over. The prominent money managers and hedge funds have booked profits and the froth blown off. Once the froth is blown off, what remains in the glass is some more froth and actual beer (stocks re-aligned, revised their earnings, growth outlook).

If you had invested when the froth was ebbing up, I am sure your portfolio would be in deep red, and this is one of the best lessons when it comes to investing — for now, in the future, and forever!

Why This Is the Best Time to Build Generational Wealth?

Bear Markets are one of the best opportunities to buy stocks or other assets at a bargain. All a retail investor can do is pick their favorite companies/stocks or ETFs, keep buying every three months, and hold tight until the next bull market.

Only those who endure the pain of bear markets,

can enjoy the fruits of a bull market!

There are always some stock market/economy cycles that will keep churning up one after the other — for example:

- US-China Trade war

- China-Hong Kong Protests

- COVID-19

- Russia-Ukraine war

- Oil/Energy Crisis

- Inflation/Deflation/Stagflation

- Bankruptcy and many more!

With all the above, the stock market will react in the short term and absorb and adapt for the long term. The bear markets are the best time to keep adding stocks/ETFs (and that’s what great investors do), and the bull markets enable them to build generational wealth.

I hope the explanation was valuable and helpful. Do share your experience on how you handle your investments during the present market scenarios.