Here is how to book profits on your stock trades like a PRO — explained with a real-time stock trade using our WIBE 3V Strategy!

Trading and Investing are akin to one another — except that the holding period of an investment vehicle varies.

Investing — People hold on to assets for a relatively long time (a few years to decades) — Staying invested.

Trading — People hold on to assets for a relatively shorter time frame (a few hours to weeks/months) — after that, they exit the investment vehicle by booking profits or a loss!

Regarding trading, it is essential to book profits when the assets reach a pre-determined profit percentage (or) as per the strategy (or) exit the trade at a loss when it hits a stop loss.

Here is a real-time scenario where we booked profits on one of our recent stock picks based on the WIBE 3V Strategy.

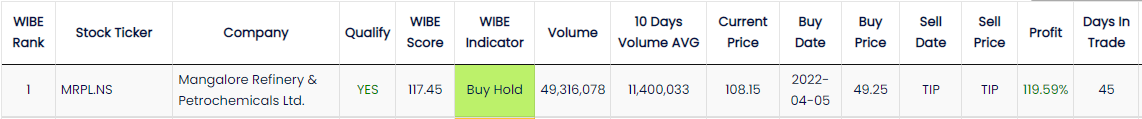

Stock Ticker: NSE:MRPL

Company: Mangalore Refinery & Petrochemical Ltd

Buy Date: 31st May 2022

Buy Price: INR 80.9

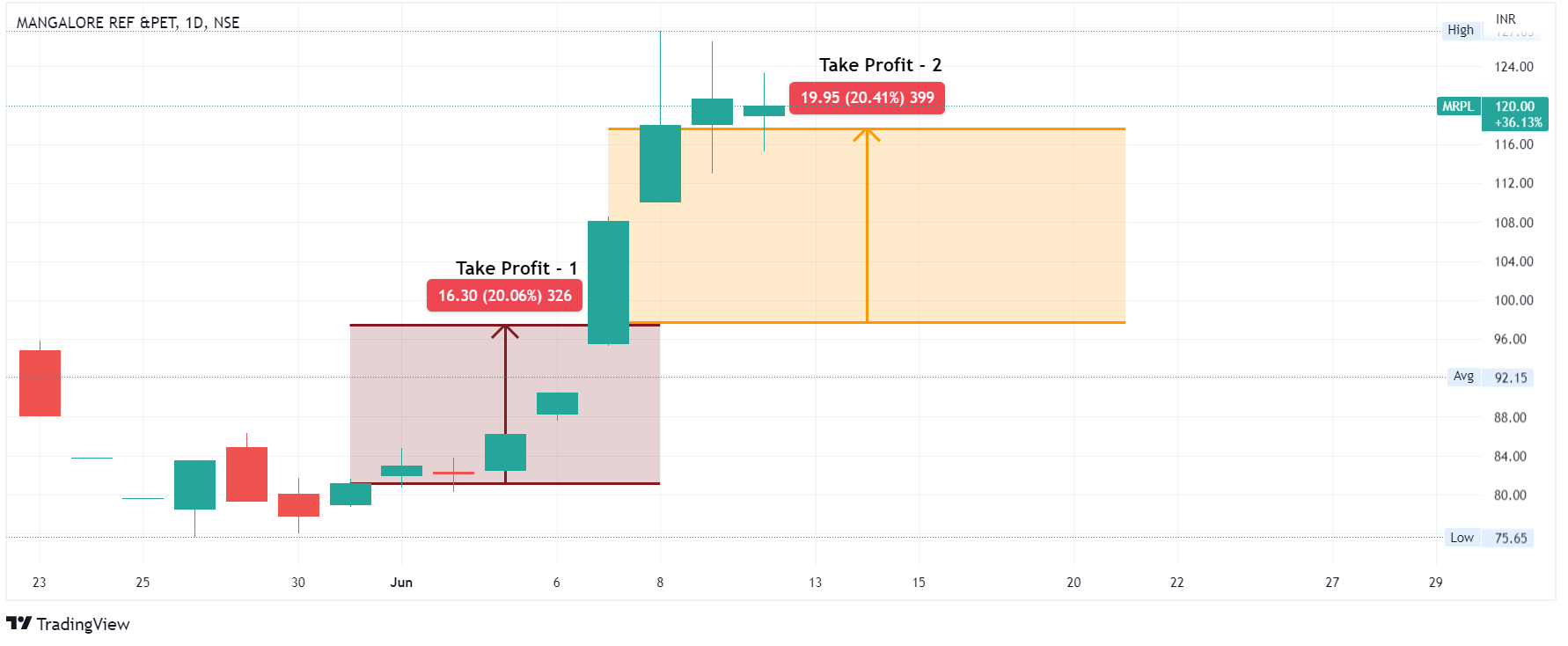

The stock has gained about 57% from its buy price of INR 80.9

According to the WIBE 3V Strategy, the stock was a BUY on 5th April 2022. Users of the WIBE 3V Strategy would have amassed an enormous profit on this trade by 120% in 45 days.

How to Book Profits Like a Pro?

Since the stock has rallied by 57% from the purchase price of INR 81, it is essential to book profits. Traders generally use the Risk to Reward Ratio (RRR); once the target is achieved, the position is closed. However, the Risk to Reward ratio may not hold well for all trading strategies; for example, a simple trend-following or the innovative WIBE 3V Strategy may not follow a Risk-Reward Ratio. Traders will continue to hold the positions until a SELL signal arises.

Traders can book profits in three ways:

- Sell a part of their positions for a profit and to readjust to the original allocation

- Sell a part of their positions when a particular profit % is achieved

- Adjust the stop loss based on the stock price movements

In this blog, let me explain the first method by which traders can book profits on their existing stock positions.

Booking Profits — Method 2:

Sell a part of their positions when a particular profit % is achieved — which can be achieved in two ways. One is to sell the shares based on the target % on a stock price level, and another is to sell the shares based on the target % on a portfolio level. These suggestions are not universal for all traders. The decision on choosing is purely based on an individual trader’s experience.

Booking Profits Based on Stock Price Target %:

Simply put, traders can sell part or all shares when the stock price appreciates (long-only trades) by a target %. There is no specific target % to book profits; however, traders can determine the same by their strategy and based on their experience or a comfortable level. Traders should also ensure they don’t book profits too often that the entire position becomes meaningless! All these can only be learned by experience in the markets.

In the case where one of the subscribers of the WIBE 3V Strategy (MRPL Trade) could book profits at, say, every 20% of price appreciation. As we do not know how far the stock price could appreciate, we can set a comfortable target % to book partial profits. Note that booking profits frequently or delaying may adversely affect the profitability of the trades. Sophisticated traders never follow the strategy described above; however, this shall hold good for anyone new to trading.

Booking Profits Based on Portfolio Level Target %:

Most traders adhere to strict position sizing and the number of positions depending on their strategy and their ability to monitor their trades. At WIBE, when I trade stocks using the 3V Strategy, I stick to ten to fifteen positions at any given time. If the markets are volatile and there are no opportunities to trade, I sit over cash waiting for the opportunities.

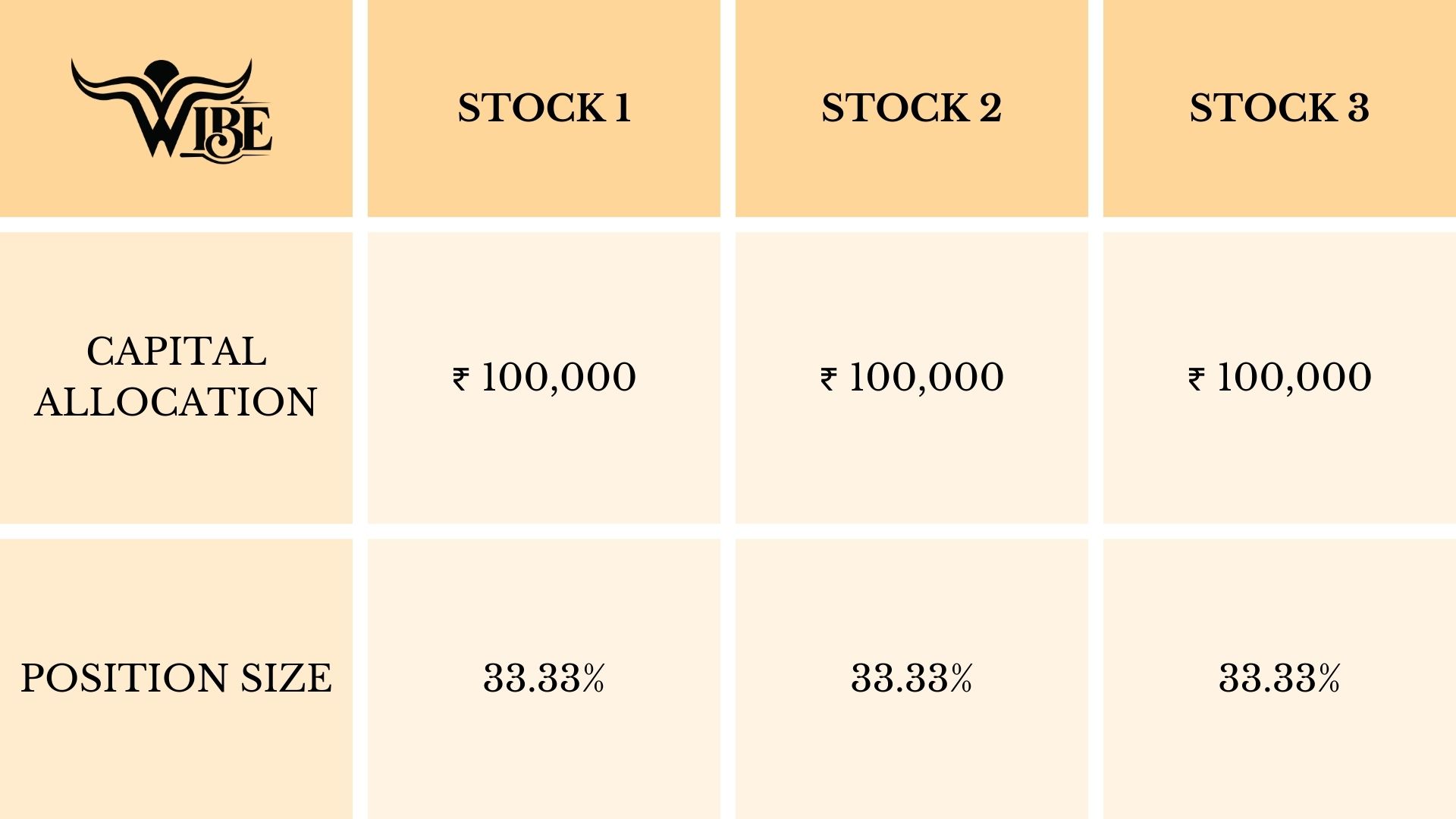

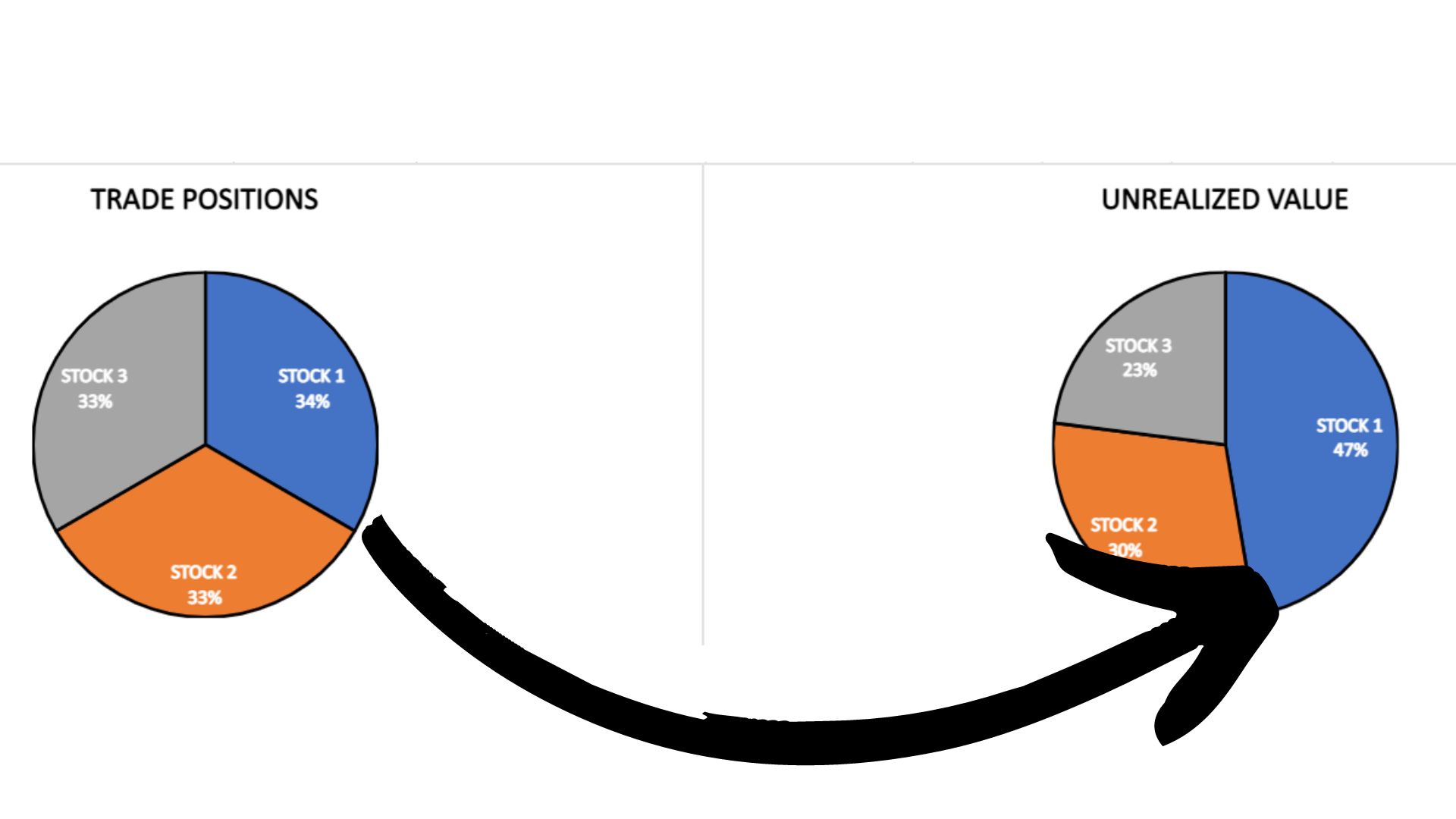

Let’s now look at the method of booking profits based on a set target % at a Portfolio level. To begin with, let’s assume a trader has three stock positions with each 33.3% allocation.

Assuming the stock positions have:

- Stock 1 → gained 75%

- Stock 2 → gained 10% and

- Stock 3 → fallen by 15%

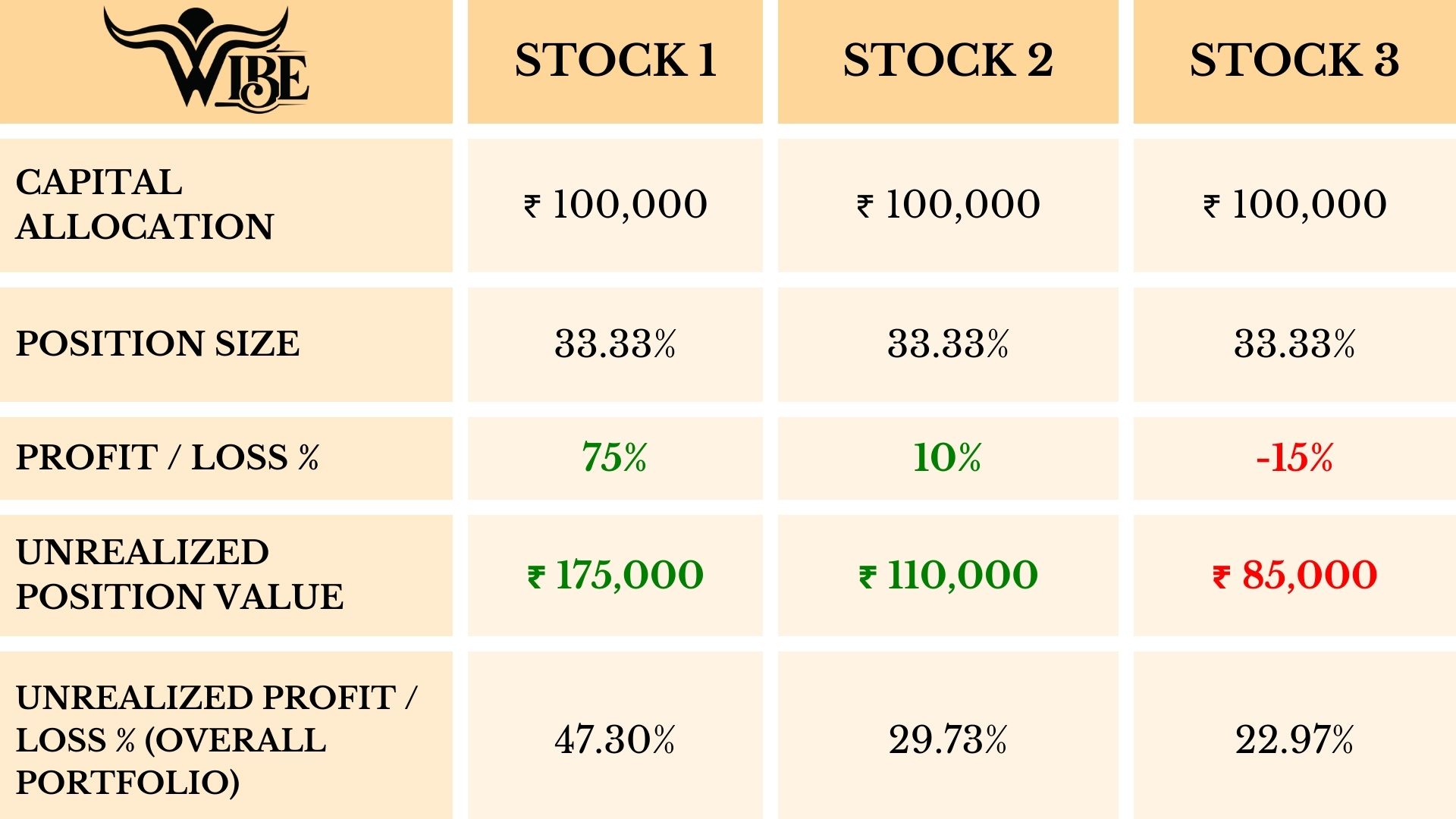

The overall portfolio and position sizes will look as below.

The position sizing of stocks moved as below:

- Stock 1 — from 33% to 47.30% of the entire portfolio

- Stock 2 — from 33% to 29.7% of the entire portfolio

- Stock 3 — from 33% to 22.97% of the entire portfolio

Not all positions may be a winner; thus, as you can see, Stock 3 might have hit a stop-loss, and a trader would have exited the position. Stock 1 has gained 75%, and thus the position that was 33% is now at 47.30% of the total portfolio. Traders can sell shares of stock 1 to align it back to 33% of the overall portfolio.

Thus traders can sell a part of their shares when a particular profit % is achieved — and the same is done in two ways. One is to sell the shares based on the target % on a stock price level, and another is to sell the shares based on the target % on a portfolio level.

I hope the explanation was valuable and helpful. Do share your experience if you have other innovative ideas for booking profits on your trades.

Do your due diligence if or when placing a trade/investing. All ideas stated here are my own and do not represent trading or investment advice.