Don’t Buy The Dips, Do This Instead — A Practical Analysis.

NASDAQ: AAPL (Apple Inc), as I write this blog, has fallen by about 3.28% and is trading at $141.81

AAPL hit its all-time high price of $182 in Jan 2022, and in the last 30 days, AAPL has fallen by 15% due to but not limited to weakness in the tech sector and high inflation, and fear of recession.

Many investors have various questions running through their minds, and here is an attempt to address them (or) at least the steps that I will adhere to if I wish to buy AAPL.

Some Questions frequently asked:

Does this correction offer an opportunity for investors to buy the dips?

How far can AAPL fall?

What could be the best time to buy AAPL?

Here is my analysis:

AAPL is a blue-chip stock that every investor aspires to own. Most investors comfortable with AAPL is that the legendary investor Warren Buffett holds about 40% or more of his core portfolio. Don’t conclude and buy AAPL just because Mr. Buffett has purchased it for the reasons that I shared — Read it here!

AAPL has fallen by 22% from its all-time high price of $182. It has a 28% upside potential if AAPL ascends back to its all-time high price.

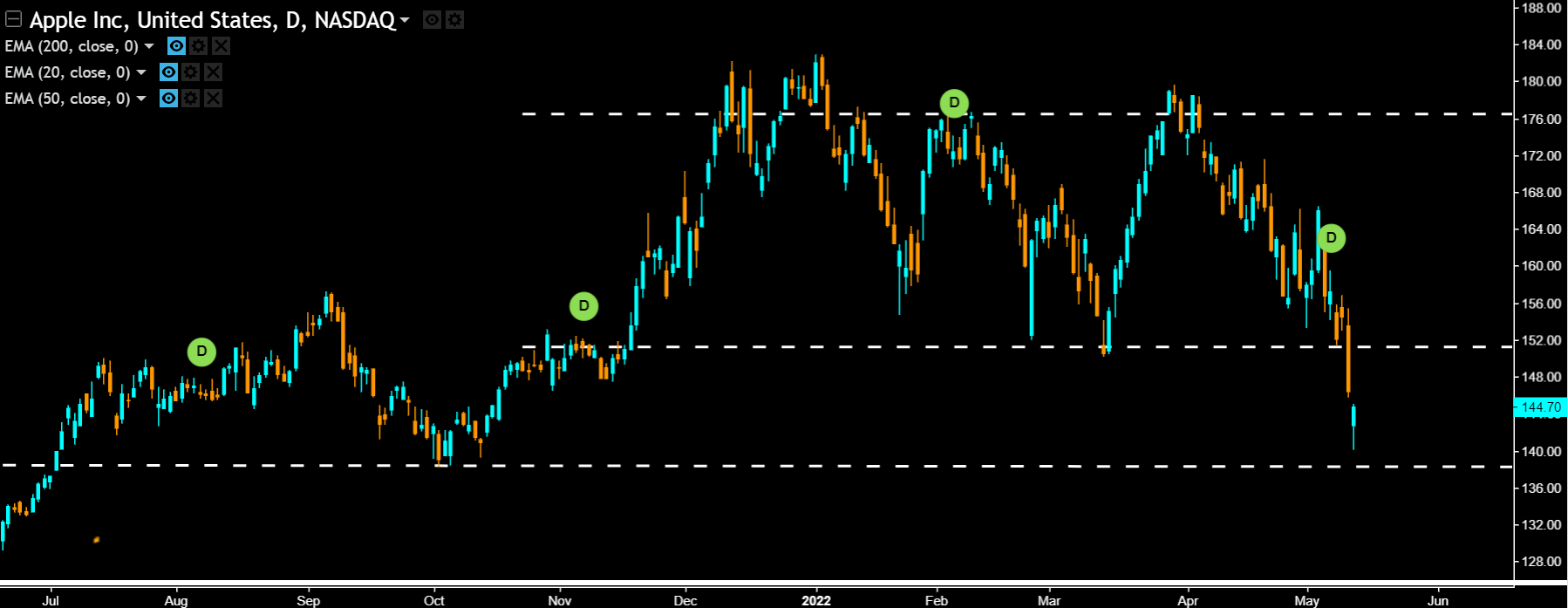

AAPL had strong support between $148 & $152, but it broke below the support range, and the next strong support was between $138 & $140. Investors must carefully watch the price action around the strong support level and see if the stock bounces off. If that does not happen, the following tentative support price range is between $110 & $120 to watch for.

Trend Analysis:

AAPL had an excellent uptrend in 2021~2022, and it has broken the uptrend recently, as shown in the charts below. Investors should not get fooled when the stock price may jump a day or two unless the stock confirms the uptrend again.

AAPL confirms its bearishness as it trades below 200-day EMA, and watch out for the dead-cross where the 20-day EMA may cross below the 200-day EMA — which will double confirm AAPL’s bearishness.

The MACD on the daily chart indicates extreme bearishness, which can be seen in the below image.

With that, we are clear that “NOW” is not the right time to “BUY” AAPL and wait for the trends or momentum to confirm the reversal.

When to buy AAPL?

One of the simplest ways is to wait for trend reversal. The image below shows the commencement of the downtrend, and one can wait till the stock price breaks the channel.

Another way is to wait for the short-term EMA to cross over the long-term EMA- as an example: The 20-day EMA cross over 200-day EMA, and the 50-day EMA crosses over the 200-day EMA (Golden Cross).

Gauging Momentum Change:

Another way (instead needs some expertise) is to check the MACD on monthly, weekly, and daily charts, and the MACD should confirm positive momentum in at least two different time frames. See the below images to compare Monthly and weekly MACD charts, indicating bearishness.

Putting it all together:

- Divide the capital allocated to buy AAPL into two or three parts.

- Wait to confirm the price action by support/resistance ranges

- Wait for the MACD to indicate a change in momentum from bearishness to bullishness

- Wait for the moving averages to confirm the bullishness by a golden cross

While there are numerous strategies, what I have described here is one among those many. Investors should not mix up methods used for investing in the long term with position or swing trades.

Do not get carried away by golden or dead crosses as the only indication of bullishness or bearishness. A typical cross-over can be used as the confirmation along with other indicators.

“All big rallies start with a golden cross, but not all golden crosses lead to a big rally”

For example, one can use the trendline break out and moving average cross overs to confirm the uptrend and vice-versa for the downtrend.

With all the above being said, based on the charts, I believe AAPL is yet to reverse, and it is worth waiting until it breaks above the downtrend line as well as exhibits the golden crossovers as explained above.

I hope this was useful, and Do your due diligence if or when placing a trade/investing. All ideas stated here are my own and do not represent trading or investment advice.