A definitive eye-opener for newbie investors

Two common questions asked by many new investors or those who are yet to commence investing in the markets:

- What and Where should you Invest?

- How much do I need to begin investing?

I am sure these questions are lingering on your mind seeking answers from Twitter to YouTube, if not from another form of social media. Let me hit straight to the point. The answer to the first question, “What and where to invest?” — is not Apple (AAPL), Amazon (AMZN), or Google (GOOG or GOOGL). The answer is plain and simple —

First, you have to invest in YOU!

I know I am repeating the same adage, but that holds forever. Hear me out on why I am saying this. A friend of mine, Chris, asked me what stocks or ETFs I have held for a long time, and I replied a couple of holdings, one of which was Samsonite International (HKG:1910), where I was sitting on a little over 100% gain in about five to six years (April 2018, if I remember correctly)! We met again at a supermarket after about a couple of months. Chris said that he bought Samsonite International when it dipped from its all-time high price due to a short-seller claiming false allegations against the then CEO regarding his Ph.D. — News Source in June 2018. I was not expecting this news, and thus, as the price started its downward trend, I exited about half my position booking profits. At that time, I was unsure whether to exit all my positions as the company’s fundamentals looked too good to ignore, considering the travel industry’s dividend yield and growth prospects.

Note: Chris entered a new stock position when I halved my position. That’s how the stock market works; there has to be a buyer when you want to sell and vice-versa. I am basing my decisions on a combination of the company’s fundamentals and news. Chris went by word-of-mouth style. In late 2018, the stock price fell to about HK$21, and I exited all my positions, whereas Chris increased his positions to average his positions. None anticipated the HK protests, followed by COVID-19, which battered the global stock markets. The travel industry was hit the worst, and imagine what could have happened to a stock like Samsonite International? Let’s look at charts for a better visual recap! I have marked approx. position exits of Samsonite International

Based on his revelations, I have marked Chris’ stock actions in the chart below.

Not to prove that I am an expert investor and Chris is not. One should not invest based on word-of-mouth or social media advice. Chris exited all his positions after the COVID-19 crash. Imagine someone who invested when the stock price was HK$30, and it dropped as low as HK$7, where Chris lost 75% of his capital. A classic scenario which all investors must have faced, that the stock price appreciates once we exit our positions after a loss — sounds familiar?

The same thing happened to Chris, and he is even now surprised to see that Samsonite International appreciated from HK$7 to HK$15 (approx as on date), giving a little over 100%. I have to be honest that I was not tracking this stock once I exited my positions. I was surprised either that the stock gave a 100% return quickly. For this reason, it is essential to invest in yourself before investing in the markets. By investing in self, I mean, one can:

Either learn through an online course or from books and start with paper trades,

or

Choose a successful trader/investor/mentor and learn from them by working alongside them.

One has to be careful when choosing an online course or a mentor to guide you on trading/investing — you can feel free to read my perspectives here. Thus, Investing in YOU is always the first and best form of Investment.

Let’s come to the next question:

How Much does one need to begin Investing?

There are no direct answers to this question. However, one can derive the solution based on:

- Debt level

- Monthly income or business income or other sources of income

- Monthly expenses

- Mandatory stuff like Insurance, Credits, emergency corpus, etc.

- Age

- Net worth and there could be more factors to consider. Note that there is no one silver bullet for all.

Let’s assume you are 20 years young and studying at a University. You have an income of $10 an hour, and you pile up 10 hours a week which makes $100 a week. That comes to $400 a month — too good money for a 20-year student, right! If there are no debts, and you are taken care of by your parents or guardians, then all these can straight go into S&P500 (VOO) without any doubt. The younger you are, you have time on your side to make compounding work for you! Assume you are in your mid-thirties, having a well-paid full-time job, then one can consider having a 70/30 (Equity/Debt) portfolio or 60/40 based on the risk appetite. As an example, One can start with:

- Equity →S&P 500 →VOO (70%)

- Debt →Bond →BND (30%)

- Emergency Corpus (not part of the portfolio)

- Cash (not part of the portfolio)

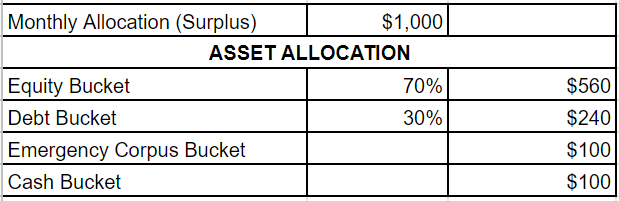

and consider allocating more funds from monthly pay towards points 1 to 3 such that the asset allocation is maintained at all times, rebalanced once a year, or as needed. For your information, I had to rebalance my equity allocation at least three times in the 2020/2021 bull run after the COVID crash. Once such a simple portfolio is set up, one can explore all sorts of asset classes and investing options. I suggest having at least 80% of your net worth invested as a simple portfolio unless you are a professional stock picker or fund manager. If you end up with $1000 after covering all expenses, you may consider allocating as below:

It is essential that as a young earner, one must learn to invest when the amounts are small (in terms of a few hundred $). At these stages of life, one can afford to experience the markets, volatility and learn to handle emotions. If not, most will usually never be ready when the amounts are large. As said by someone,

Before you Learn to manage $100,000, you should learn to manage $1000

That’s why it is essential to start investing when you are young, so you learn to manage $1000 to gain experience and become ready to handle $100K. The methodology to manage $100K is not the same as you do for $1K. The same applies when for a million $.

To Summarize,

There is neither a lower nor upper limit in terms of $ value to invest in the markets. The limitation exists only in terms of experience, exposure, and mindset. I hope this answers your questions as a newbie investor. Let us know if you have more questions, and we are happy to answer them to our best!

Happy Trading / Investing!